How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

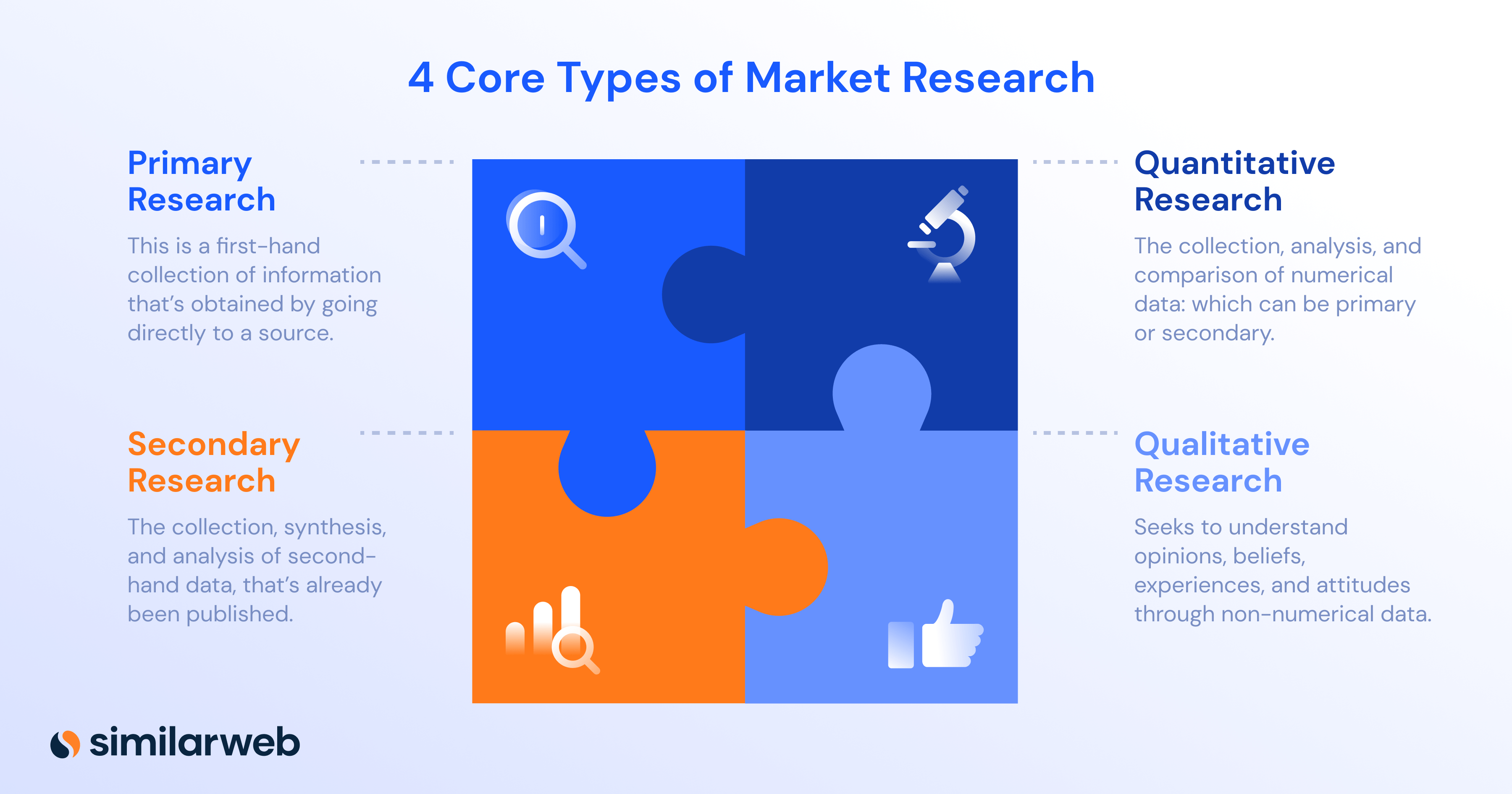

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

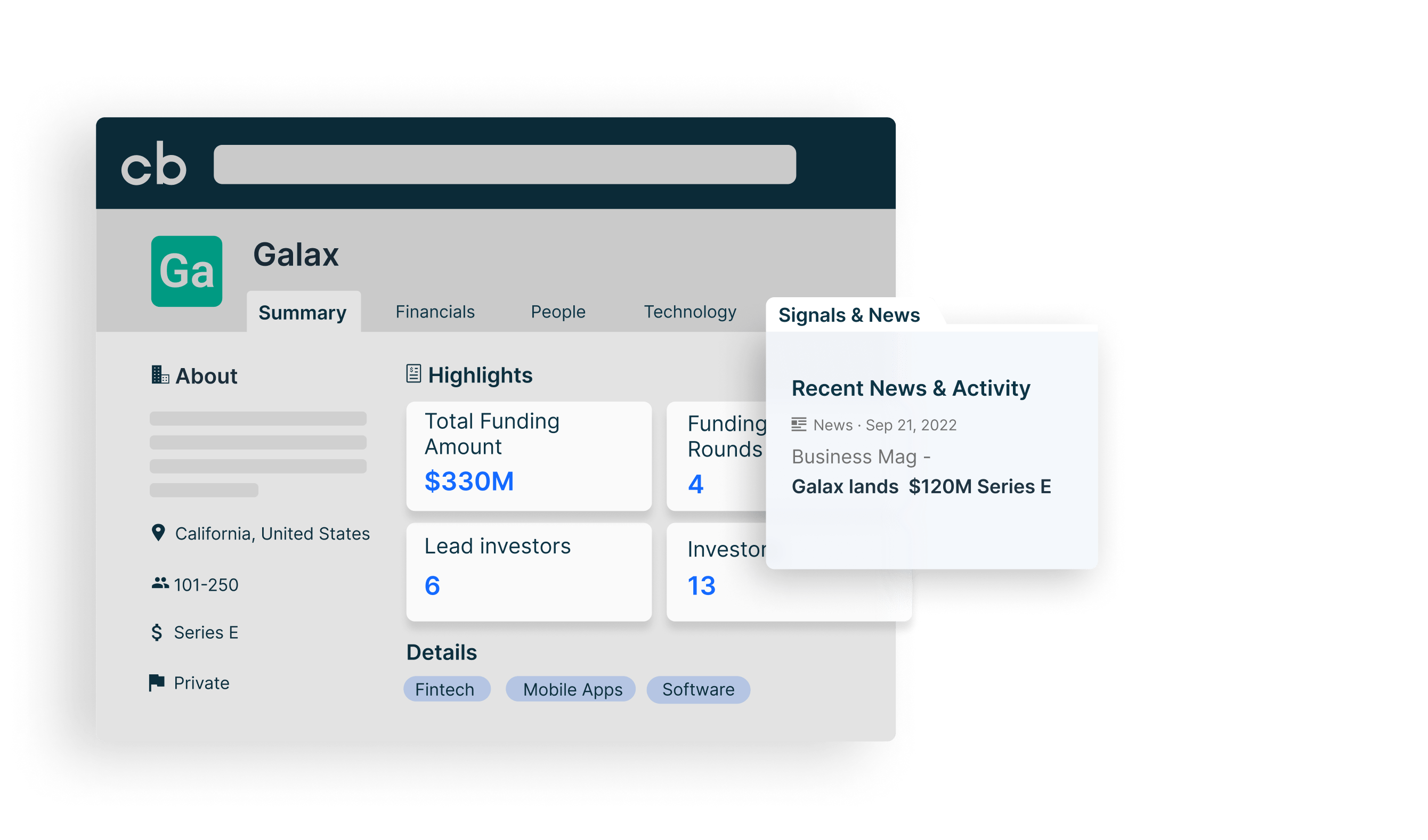

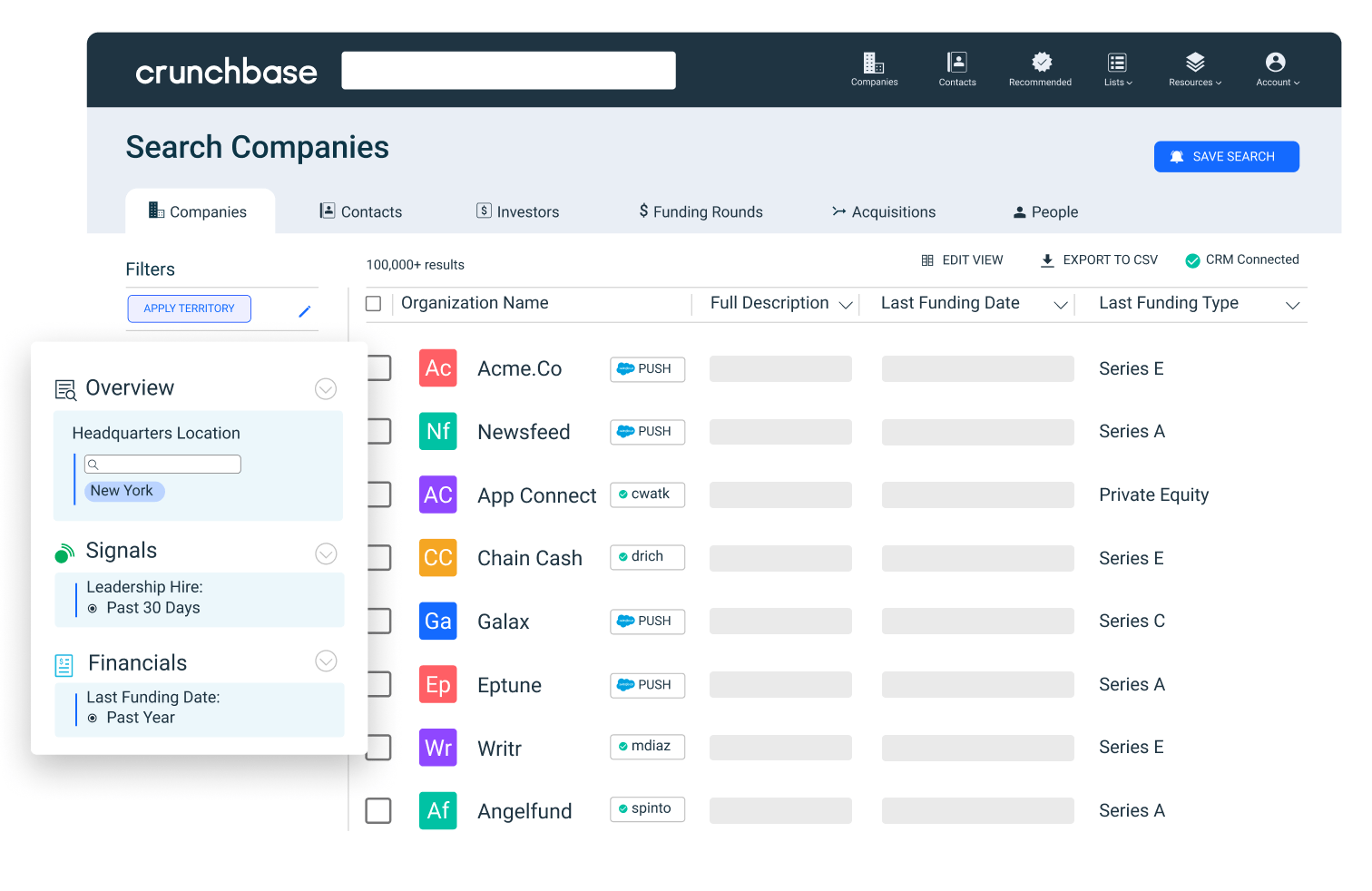

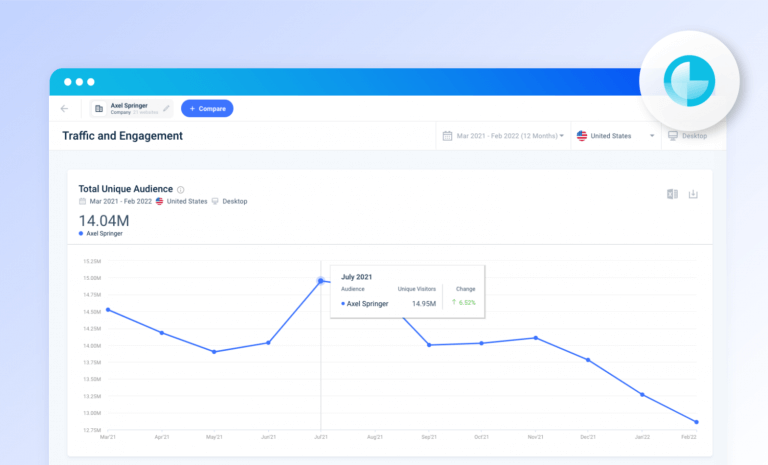

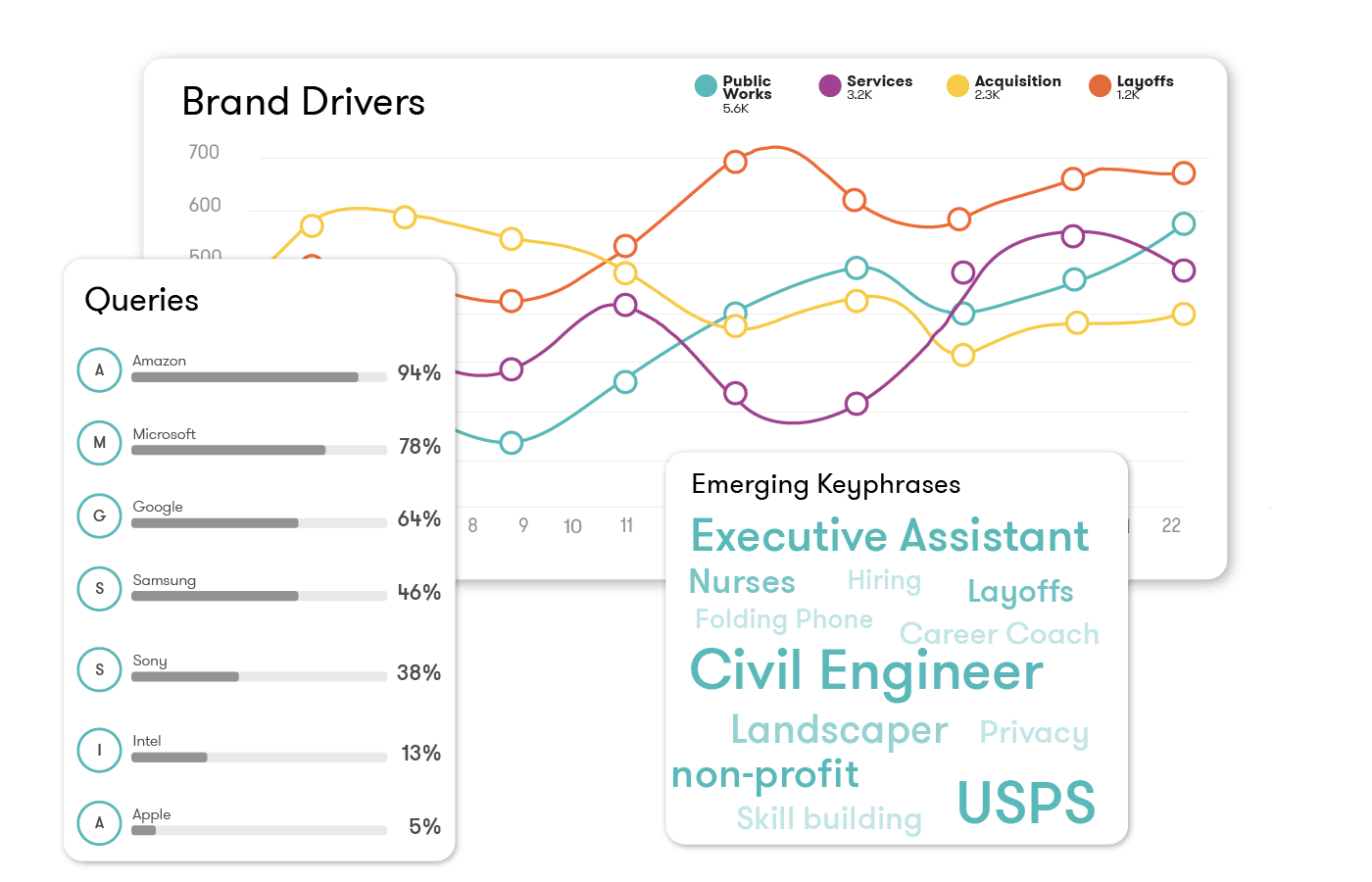

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

- Search Search Please fill out this field.

What Is Market Research?

- How It Works

- Primary vs. Secondary

- How to Conduct Research

The Bottom Line

- Marketing Essentials

How to Do Market Research, Types, and Example

:max_bytes(150000):strip_icc():format(webp)/dd453b82d4ef4ce8aac2e858ed00a114__alexandra_twin-5bfc262b46e0fb0026006b77.jpeg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example CURRENT ARTICLE

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Joules Garcia / Investopedia

Market research examines consumer behavior and trends in the economy to help a business develop and fine-tune its business idea and strategy. It helps a business understand its target market by gathering and analyzing data.

Market research is the process of evaluating the viability of a new service or product through research conducted directly with potential customers. It allows a company to define its target market and get opinions and other feedback from consumers about their interest in a product or service.

Research may be conducted in-house or by a third party that specializes in market research. It can be done through surveys and focus groups, among other ways. Test subjects are usually compensated with product samples or a small stipend for their time.

Key Takeaways

- Companies conduct market research before introducing new products to determine their appeal to potential customers.

- Tools include focus groups, telephone interviews, and questionnaires.

- The results of market research inform the final design of the product and determine how it will be positioned in the marketplace.

- Market research usually combines primary information, gathered directly from consumers, and secondary information, which is data available from external sources.

Market Research

How market research works.

Market research is used to determine the viability of a new product or service. The results may be used to revise the product design and fine-tune the strategy for introducing it to the public. This can include information gathered for the purpose of determining market segmentation . It also informs product differentiation , which is used to tailor advertising.

A business engages in various tasks to complete the market research process. It gathers information based on the market sector being targeted by the product. This information is then analyzed and relevant data points are interpreted to draw conclusions about how the product may be optimally designed and marketed to the market segment for which it is intended.

It is a critical component in the research and development (R&D) phase of a new product or service introduction. Market research can be conducted in many different ways, including surveys, product testing, interviews, and focus groups.

Market research is a critical tool that companies use to understand what consumers want, develop products that those consumers will use, and maintain a competitive advantage over other companies in their industry.

Primary Market Research vs. Secondary Market Research

Market research usually consists of a combination of:

- Primary research, gathered by the company or by an outside company that it hires

- Secondary research, which draws on external sources of data

Primary Market Research

Primary research generally falls into two categories: exploratory and specific research.

- Exploratory research is less structured and functions via open-ended questions. The questions may be posed in a focus group setting, telephone interviews, or questionnaires. It results in questions or issues that the company needs to address about a product that it has under development.

- Specific research delves more deeply into the problems or issues identified in exploratory research.

Secondary Market Research

All market research is informed by the findings of other researchers about the needs and wants of consumers. Today, much of this research can be found online.

Secondary research can include population information from government census data , trade association research reports , polling results, and research from other businesses operating in the same market sector.

History of Market Research

Formal market research began in Germany during the 1920s. In the United States, it soon took off with the advent of the Golden Age of Radio.

Companies that created advertisements for this new entertainment medium began to look at the demographics of the audiences who listened to each of the radio plays, music programs, and comedy skits that were presented.

They had once tried to reach the widest possible audience by placing their messages on billboards or in the most popular magazines. With radio programming, they had the chance to target rural or urban consumers, teenagers or families, and judge the results by the sales numbers that followed.

Types of Market Research

Face-to-face interviews.

From their earliest days, market research companies would interview people on the street about the newspapers and magazines that they read regularly and ask whether they recalled any of the ads or brands that were published in them. Data collected from these interviews were compared to the circulation of the publication to determine the effectiveness of those ads.

Market research and surveys were adapted from these early techniques.

To get a strong understanding of your market, it’s essential to understand demand, market size, economic indicators, location, market saturation, and pricing.

Focus Groups

A focus group is a small number of representative consumers chosen to try a product or watch an advertisement.

Afterward, the group is asked for feedback on their perceptions of the product, the company’s brand, or competing products. The company then takes that information and makes decisions about what to do with the product or service, whether that's releasing it, making changes, or abandoning it altogether.

Phone Research

The man-on-the-street interview technique soon gave way to the telephone interview. A telephone interviewer could collect information in a more efficient and cost-effective fashion.

Telephone research was a preferred tactic of market researchers for many years. It has become much more difficult in recent years as landline phone service dwindles and is replaced by less accessible mobile phones.

Survey Research

As an alternative to focus groups, surveys represent a cost-effective way to determine consumer attitudes without having to interview anyone in person. Consumers are sent surveys in the mail, usually with a coupon or voucher to incentivize participation. These surveys help determine how consumers feel about the product, brand, and price point.

Online Market Research

With people spending more time online, market research activities have shifted online as well. Data collection still uses a survey-style form. But instead of companies actively seeking participants by finding them on the street or cold calling them on the phone, people can choose to sign up, take surveys, and offer opinions when they have time.

This makes the process far less intrusive and less rushed, since people can participate on their own time and of their own volition.

How to Conduct Market Research

The first step to effective market research is to determine the goals of the study. Each study should seek to answer a clear, well-defined problem. For example, a company might seek to identify consumer preferences, brand recognition, or the comparative effectiveness of different types of ad campaigns.

After that, the next step is to determine who will be included in the research. Market research is an expensive process, and a company cannot waste resources collecting unnecessary data. The firm should decide in advance which types of consumers will be included in the research, and how the data will be collected. They should also account for the probability of statistical errors or sampling bias .

The next step is to collect the data and analyze the results. If the two previous steps have been completed accurately, this should be straightforward. The researchers will collect the results of their study, keeping track of the ages, gender, and other relevant data of each respondent. This is then analyzed in a marketing report that explains the results of their research.

The last step is for company executives to use their market research to make business decisions. Depending on the results of their research, they may choose to target a different group of consumers, or they may change their price point or some product features.

The results of these changes may eventually be measured in further market research, and the process will begin all over again.

Benefits of Market Research

Market research is essential for developing brand loyalty and customer satisfaction. Since it is unlikely for a product to appeal equally to every consumer, a strong market research program can help identify the key demographics and market segments that are most likely to use a given product.

Market research is also important for developing a company’s advertising efforts. For example, if a company’s market research determines that its consumers are more likely to use Facebook than X (formerly Twitter), it can then target its advertisements to one platform instead of another. Or, if they determine that their target market is value-sensitive rather than price-sensitive, they can work on improving the product rather than reducing their prices.

Market research only works when subjects are honest and open to participating.

Example of Market Research

Many companies use market research to test new products or get information from consumers about what kinds of products or services they need and don’t currently have.

For example, a company that’s considering starting a business might conduct market research to test the viability of its product or service. If the market research confirms consumer interest, the business can proceed confidently with its business plan . If not, the company can use the results of the market research to make adjustments to the product to bring it in line with customer desires.

What Are the Main Types of Market Research?

The main types of market research are primary research and secondary research. Primary research includes focus groups, polls, and surveys. Secondary research includes academic articles, infographics, and white papers.

Qualitative research gives insights into how customers feel and think. Quantitative research uses data and statistics such as website views, social media engagement, and subscriber numbers.

What Is Online Market Research?

Online market research uses the same strategies and techniques as traditional primary and secondary market research, but it is conducted on the Internet. Potential customers may be asked to participate in a survey or give feedback on a product. The responses may help the researchers create a profile of the likely customer for a new product.

What Are Paid Market Research Surveys?

Paid market research involves rewarding individuals who agree to participate in a study. They may be offered a small payment for their time or a discount coupon in return for filling out a questionnaire or participating in a focus group.

What Is a Market Study?

A market study is an analysis of consumer demand for a product or service. It looks at all of the factors that influence demand for a product or service. These include the product’s price, location, competition, and substitutes as well as general economic factors that could influence the new product’s adoption, for better or worse.

Market research is a key component of a company’s research and development (R&D) stage. It helps companies understand in advance the viability of a new product that they have in development and to see how it might perform in the real world.

Britannica Money. “ Market Research .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

:max_bytes(150000):strip_icc():format(webp)/CPM-edit-e635f4dfe70c4749986100b8429533dc.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Market Research: What It Is, Why It Matters, and How To Get It Right

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

What is market research?

What is market research used for? How important is it? And, how do you choose the right type of research for your business?

Sit back, take five, and I’ll explain the different types of research , what tools are best for the job, and how you can leverage them to grow your business and master your market .

Market research definition:

Market research means to systematically collect and analyze data about a target market or defined segment. It’s a multivariate process that uncovers key facts and insights to inform decisions.

Whether you’re launching a new product , looking for ways to expand a business, or seeking out efficiencies in an existing company, market research is a highly effective way to flesh-out ideas, innovate, and grow.

Advantages of market research

Market research helps you identify your greatest strengths, threats, and opportunities. It can help you find your way when markets become tough to predict and find efficient ways to grow your business .

- Reduce costs

- Define detailed customer personas

- Make data-driven decisions

- Find new opportunities for growth

- Unpack competitor’s successes

- Develop an informed content marketing strategy

- Identify trends

- Inform market analysis

- Discover the best marketing channels to use

- Find the best ways to communicate with customers

- Benchmark performance against rivals

Online market research can help the whole business at any stage of its life. When practiced consistently and systematically, you can realize its many benefits.

Why is market research important?

Market research helps you identify your greatest threats. And it also gives you a clear picture of opportunities you can capitalize on for greater returns on your business investments, or ROI.

Understanding your specific market on different levels and from different perspectives helps you reach well-informed, data-informed decisions . The process can involve multiple phases. But, if you follow a systematic approach using a market research template , your efforts will pay off.

For more, check out our blog: Importance of Market Research: 9 Reasons Why It’s Crucial for Your Business

To skip ahead and start right now, download our free pack of market research templates.

Different types of market research

Market research is a questions and answers game. Once you’ve asked the important questions, you’ll need to choose the right type of research to get your answers. There are four core types of research, each of which can be applied to help you solve a problem or gather insights to inform key decisions.

Primary market research

Primary market research is the first-hand collection of data. It’s data that’s not available to others, and can be obtained in a number of ways. Here are the most common.

- Web Metrics Use analytics software that provides traffic and engagement metrics to understand how audiences behave.

- Observation To observe how users behave and navigate your site, you can install software that records visits and creates heatmaps. Such tools are useful for qualitative research regarding your UX/UI and at the same time, quantify the findings.

- Customer surveys Survey questionnaires and polls can be distributed to any number of customers through email, SMS, your site, or social media. They let you collect both qualitative and quantitative data from respondents using open-ended questions.

- Focus groups You select a small number of people for a group discussion. A moderator leads the session with questions and records the conclusions. This is also a form of qualitative research, and you would use it to get in-depth information.

- Face-to-face interviews Another qualitative assessment method is one-on-one interviews. Consumers representative of your target audience or a segment of it are selected to answer questions about a specific research topic.

- Phone calls To involve a larger number of people and get more answers, you can conduct surveys over the phone. These interviews would be less specific and include fewer questions.

Helpful: A complete guide to doing primary market research

Secondary market research

Secondary research is second-hand data that has already been produced. It’s available to all who wish to consume it. Using this type of data is preferred by those who wish to keep costs low, as it can be quicker and freely available.

- Government reports and census data Annual, quarterly, and other periodic industry reports are a rich data source to tap into. Government organizations publish statistics in areas of trade, ecommerce, and finance.

- Academic papers and educational resources University research is a source of high-quality information. This is useful for in-depth background information on a broad scale.

- Online articles and case studies, public and commercial sources Industry-specific publications can be a valuable source of information for market segmentation, providing you with data and insights on market trends or a specific market segment or niche.

Further reading: A complete guide to doing desk research

Qualitative market research

Qualitative market research is one of the best ways to understand how people think or feel about a brand, product, or service. It takes more time to plan and analyze the results than other market research types. However, with tools like market research surveys , there are quick and effective ways to do it.

As some of the methods are outlined in the primary and secondary research sections, I’ve included a short list of qualitative research methods below.

- Focus groups

- Case study or whitepaper

- Online forums

- Biometrics

- Ethnography

Helpful: Read the complete guide to qualitative research and 83 qualitative research questions & examples

Quantitative market research

Quantitative market research is all about numbers. It collects numerical data to help answer specific research questions . The information collected can be easily quantified and analyzed to establish trends, insights, and patterns.

With this type of research, you’ve got three core data collection methods. However, you’ve also got to consider the design of the research, which can impact which method is used.

What is market research used for?

The applications for market research are virtually limitless. Market research can help you unravel the most complex of business challenges to reach data-driven decisions , and when used consistently, it can help you navigate turbulent times, fuel growth, and support your success . Here are just a few examples of what market research is used for, with a few real-world examples thrown in for good measure.

1. Company research

Market research allows you to shine a spotlight on any business and unpack its wins and losses for your own gain. Let’s say you are doing market research for a business plan ; you’ll likely want to evaluate the successes of others in your industry. Doing systematic company research is a proven way to inform a SWOT analysis .

Doing industry analysis can show you who your industry leaders are , along with any emerging players showing exponential growth.

Let’s say I want to find out which companies to research, I would use Similarweb Digital Research Intelligence to analyze an industry. Here, I can see who my top companies to watch are instantly. It also shows me other companies showing rapid growth in my market.

Read More: How to Research a Company: The Ultimate Guide

2. Competitive benchmarking

Most of your relevant data will come from your competition. If you plan to offer something that’s new for you but already exists in the market, learn from other’s mistakes and successes. If your goal is to evaluate and optimize, collect competitors’ data, and compare it to yours. See what works for them, find their weak spots, and improve on them.

What market research gives you here, is the ability to systematically compare each of your rivals. And, it’s not as complex as it sounds either. Simply choose a type of competitive analysis frameworks to use, complete the template for each; then compare the results to uncover relevant insights.

Read More: The Why and How of Competitive Benchmarking

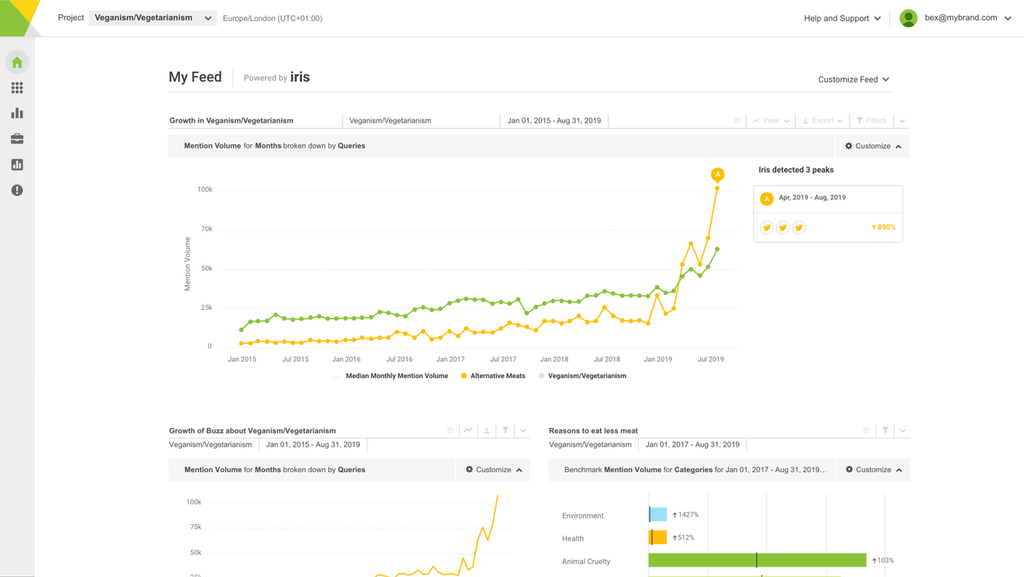

3. Trendspotting

Another objective for market researchers is to forecast upcoming trends. Data collection over time helps you understand the dynamics of the market. Some markets have strong seasonal fluctuations. Increased shopping during December is an obvious example, but often these shifts are not always evident unless you measure and analyze them specifically.

With the data from your historical market research, you can evaluate their impact and the likelihood you will keep seeing these trends. Based on that, you can make predictions about future developments.

4. Audience analysis

Who will find your product most useful and why?

Examining the size of your audience and the existing demand for your product or services is crucial. Understanding your target audience allows you to build your product offering and marketing strategy more efficiently. You also want to learn first-hand where people buy this type of product and how much they are willing to spend so that you can estimate your reachable market share .

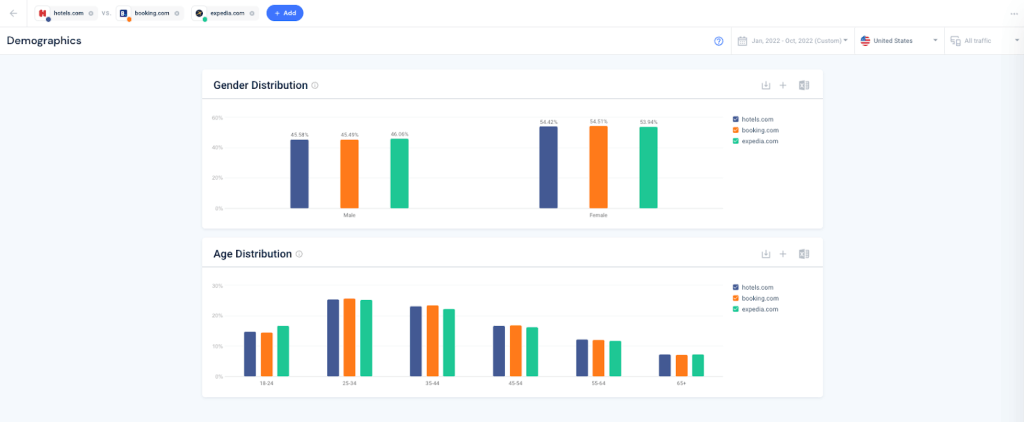

Here’s a quick example of how we use Similarweb to do effective audience analysis . You can unpack key audience demographics for any site you choose. And get up-to-date stats about gender, age, location, interests, browsing habits, and more.

5. Market segmentation

There are lots of ways to segment a market. Doing this well can deliver higher conversions, reduce costs, redefine marketing strategies, and help you connect with customers on a more personal level. Market research can help you do most types of market segmentation, the most widely adopted of all is demographic segmentation . Here, you look for shared but specific characteristics of a target audience.

Using Similarweb, I can view audience demographics for a website, and compare it side-by-side with rival sites. In this example, I am looking at hotel booking sites to try and spot any difference between the respective audiences of each.

Helpful: Read our complete guide to market segmentation

6. Marketing strategy

Market research can also help you reach the right decision regarding where to advertise or market your business. After analyzing the data, you’ll know which marketing channels are most effective with your target audience. You can also use research to look at the specific keywords and ad creatives that are generating the best responses and ROI.

Similarweb Digital Research Intelligence makes this type of research effortless. Within the marketing channels tab, you can analyze an entire industry or hone in on a specific site of interest. View the various channels across social media, email, direct, organic search, paid search, and display ads to see which channels convert and where the highest channel traffic comes from.

7. Customer experience

Market research is your best way to get information that isn’t naturally visible but that may significantly affect your business. Just think, the fact that your users don’t complain doesn’t necessarily mean they are all delighted with what you offer.

While some customers tend to keep their criticism to themselves, others will be vocal and leave reviews online. Market research is a powerful tool to help inform improvements to services and products alike. Asking for feedback, listening to it, and looking at the feedback left for rivals in your market can uncover telling insights that can shape service offerings, marketing campaigns, and new feature development.

To see what people use market research for and view real-world instances of research in action, head over to our market research examples page.

Tools for market research

When we look at what market research is, the answer is always rooted in data . Over 100 years ago, vehicle manufacturers undertook extensive research to help them develop different models to suit various segments of society. Fast-forward 100 years, and we find similar applications still exist. However, what’s changed are the tools being used and, more importantly, the accessibility of those tools to a far broader audience .

There are more market intelligence tools in existence today than ever before. Here’s a quick summary of a few you can use to collect information for your market research.

- Google Trends Google Trends is a valuable resource for quantitative research data about market tendencies and user behavior.

- Similarweb Research Intelligence Get the freshest digital intelligence from a platform that shows the insights that count. With the ability to analyze an entire market in an instant and unpick competitors’ wins and losses online, you can count on it to help you perform quick and effective market research.

- Hotjar The digital tool lets you observe and record user behavior on your website. It also creates heatmaps of your pages so you can analyze how visitors navigate.

- SurveyMonkey Create your own online survey with this free tool. SurveyMonkey provides templates for questionnaires and lets you distribute them through your various channels, then collect and interpret results.

- YouGov This platform offers its users daily with thousands of data points and statistics on consumer attitudes, opinions, and behavior.

- Pew Research Center This non-profit organization conducts and publishes public opinion polling, demographic research, content analysis, and other data-driven social science research.

- Living Facts The site provides current statistics about the American population, including demographics, social and health issues, opinions, and more.

Read this post to see what market research tools are hot right now.

Wrapping up: what is market research

Market research is insight. It gives you information to fuel key decisions in your business. Without it, companies must navigate their market uncertainly and make key decisions based on instinct or outdated data.

Similarweb transforms the way companies do market research . There’s no expensive outlay for prolonged research reports that take an age to produce. The data is the freshest there is; it’s credible and shows traffic trends and comparable performance like no other.

Try using it to answer your next big market research question.

Stop Guessing, Start Analyzing

Get actionable insights for market research here

What are the benefits of market research?

Effective market research helps businesses understand and improve their position while also identifying potential threats and opportunities, while also spotting emerging trends .

What is the main purpose of market research?

The main benefit of market research is insight. It can give you access to the data you need to make decisions in your business. Before you invest money or time in any venture, use market research to inform your decision.

What’s the difference between primary and secondary market research?

Primary research is research you conduct on your own that uses numbers and metrics, and secondary research is research that was done by someone else with a qualitative focus.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Most Popular Messaging Apps Worldwide 2023

Market Sizing: Measuring Your TAM, SAM, and SOM

How to Research a Company: The Ultimate Guide

How To Create Better Competitive Analysis Reports

Fresh Updates: Analyze Entire Companies With Company Analysis

Get game-changing digital insights today.

Contact us to set up a call with a market research specialist

How To Do Market Research: Definition, Types, Methods

Jul 25, 2024

11 min. read

Market research isn’t just collecting data. It’s a strategic tool that allows businesses to gain a competitive advantage while making the best use of their resources. Research reveals valuable insights into your target audience about their preferences, buying habits, and emerging demands — all of which help you unlock new opportunities to grow your business.

When done correctly, market research can minimize risks and losses, spur growth, and position you as a leader in your industry.

Let’s explore the basic building blocks of market research and how to collect and use data to move your company forward:

Table of Contents

What Is Market Research?

Why is market research important, market analysis example, 5 types of market research, what are common market research questions, what are the limitations of market research, how to do market research, improving your market research with radarly.

Market Research Definition: The process of gathering, analyzing, and interpreting information about a market or audience.

Market research studies consumer behavior to better understand how they perceive products or services. These insights help businesses identify ways to grow their current offering, create new products or services, and improve brand trust and brand recognition .

You might also hear market research referred to as market analysis or consumer research .

Traditionally, market research has taken the form of focus groups, surveys, interviews, and even competitor analysis . But with modern analytics and research tools, businesses can now capture deeper insights from a wider variety of sources, including social media, online reviews, and customer interactions. These extra layers of intel can help companies gain a more comprehensive understanding of their audience.

With consumer preferences and markets evolving at breakneck speeds, businesses need a way to stay in touch with what people need and want. That’s why the importance of market research cannot be overstated.

Market research offers a proactive way to identify these trends and make adjustments to product development, marketing strategies , and overall operations. This proactive approach can help businesses stay ahead of the curve and remain agile as markets shift.

Market research examples abound — given the number of ways companies can get inside the minds of their customers, simply skimming through your business’s social media comments can be a form of market research.

A restaurant chain might use market research methods to learn more about consumers’ evolving dining habits. These insights might be used to offer new menu items, re-examine their pricing strategies, or even open new locations in different markets, for example.

A consumer electronics company might use market research for similar purposes. For instance, market research may reveal how consumers are using their smart devices so they can develop innovative features.

Market research can be applied to a wide range of use cases, including:

- Testing new product ideas

- Improve existing products

- Entering new markets

- Right-sizing their physical footprints

- Improving brand image and awareness

- Gaining insights into competitors via competitive intelligence

Ultimately, companies can lean on market research techniques to stay ahead of trends and competitors while improving the lives of their customers.

Market research methods take different forms, and you don’t have to limit yourself to just one. Let’s review the most common market research techniques and the insights they deliver.

1. Interviews

3. Focus Groups

4. Observations

5. AI-Driven Market Research

One-on-one interviews are one of the most common market research techniques. Beyond asking direct questions, skilled interviewers can uncover deeper motivations and emotions that drive purchasing decisions. Researchers can elicit more detailed and nuanced responses they might not receive via other methods, such as self-guided surveys.

Interviews also create the opportunity to build rapport with customers and prospects. Establishing a connection with interviewees can encourage them to open up and share their candid thoughts, which can enrich your findings. Researchers also have the opportunity to ask clarifying questions and dig deeper based on individual responses.

Market research surveys provide an easy entry into the consumer psyche. They’re cost-effective to produce and allow researchers to reach lots of people in a short time. They’re also user-friendly for consumers, which allows companies to capture more responses from more people.

Big data and data analytics are making traditional surveys more valuable. Researchers can apply these tools to elicit a deeper understanding from responses and uncover hidden patterns and correlations within survey data that were previously undetectable.

The ways in which surveys are conducted are also changing. With the rise of social media and other online channels, brands and consumers alike have more ways to engage with each other, lending to a continuous approach to market research surveys.

3. Focus groups

Focus groups are “group interviews” designed to gain collective insights. This interactive setting allows participants to express their thoughts and feelings openly, giving researchers richer insights beyond yes-or-no responses.

One of the key benefits of using focus groups is the opportunity for participants to interact with one another. They spark discussions while sharing diverse viewpoints. These sessions can uncover underlying motivations and attitudes that may not be easily expressed through other research methods.

Observing your customers “in the wild” might feel informal, but it can be one of the most revealing market research techniques of all. That’s because you might not always know the right questions to ask. By simply observing, you can surface insights you might not have known to look for otherwise.

This method also delivers raw, authentic, unfiltered data. There’s no room for bias and no potential for participants to accidentally skew the data. Researchers can also pick up on non-verbal cues and gestures that other research methods may fail to capture.

5. AI-driven market research

One of the newer methods of market research is the use of AI-driven market research tools to collect and analyze insights on your behalf. AI customer intelligence tools and consumer insights software like Meltwater Radarly take an always-on approach by going wherever your audience is and continuously predicting behaviors based on current behaviors.

By leveraging advanced algorithms, machine learning, and big data analysis , AI enables companies to uncover deep-seated patterns and correlations within large datasets that would be near impossible for human researchers to identify. This not only leads to more accurate and reliable findings but also allows businesses to make informed decisions with greater confidence.

Tip: Learn how to use Meltwater as a research tool , how Meltwater uses AI , and learn more about consumer insights and about consumer insights in the fashion industry .

No matter the market research methods you use, market research’s effectiveness lies in the questions you ask. These questions should be designed to elicit honest responses that will help you reach your goals.

Examples of common market research questions include:

Demographic market research questions

- What is your age range?

- What is your occupation?

- What is your household income level?

- What is your educational background?

- What is your gender?

Product or service usage market research questions

- How long have you been using [product/service]?

- How frequently do you use [product/service]?

- What do you like most about [product/service]?

- Have you experienced any problems using [product/service]?

- How could we improve [product/service]?

- Why did you choose [product/service] over a competitor’s [product/service]?

Brand perception market research questions

- How familiar are you with our brand?

- What words do you associate with our brand?

- How do you feel about our brand?

- What makes you trust our brand?

- What sets our brand apart from competitors?

- What would make you recommend our brand to others?

Buying behavior market research questions

- What do you look for in a [product/service]?

- What features in a [product/service] are important to you?

- How much time do you need to choose a [product/service]?

- How do you discover new products like [product/service]?

- Do you prefer to purchase [product/service] online or in-store?

- How do you research [product/service] before making a purchase?

- How often do you buy [product/service]?

- How important is pricing when buying [product/service]?

- What would make you switch to another brand of [product/service]?

Customer satisfaction market research questions

- How happy have you been with [product/service]?

- What would make you more satisfied with [product/service]?

- How likely are you to continue using [product/service]?

Bonus Tip: Compiling these questions into a market research template can streamline your efforts.

Market research can offer powerful insights, but it also has some limitations. One key limitation is the potential for bias. Researchers may unconsciously skew results based on their own preconceptions or desires, which can make your findings inaccurate.

- Depending on your market research methods, your findings may be outdated by the time you sit down to analyze and act on them. Some methods struggle to account for rapidly changing consumer preferences and behaviors.

- There’s also the risk of self-reported data (common in online surveys). Consumers might not always accurately convey their true feelings or intentions. They might provide answers they think researchers are looking for or misunderstand the question altogether.

- There’s also the potential to miss emerging or untapped markets . Researchers are digging deeper into what (or who) they already know. This means you might be leaving out a key part of the story without realizing it.

Still, the benefits of market research cannot be understated, especially when you supplement traditional market research methods with modern tools and technology.

Let’s put it all together and explore how to do market research step-by-step to help you leverage all its benefits.

Step 1: Define your objectives

You’ll get more from your market research when you hone in on a specific goal : What do you want to know, and how will this knowledge help your business?

This step will also help you define your target audience. You’ll need to ask the right people the right questions to collect the information you want. Understand the characteristics of the audience and what gives them authority to answer your questions.

Step 2: Select your market research methods

Choose one or more of the market research methods (interviews, surveys, focus groups, observations, and/or AI-driven tools) to fuel your research strategy.

Certain methods might work better than others for specific goals . For example, if you want basic feedback from customers about a product, a simple survey might suffice. If you want to hone in on serious pain points to develop a new product, a focus group or interview might work best.

You can also source secondary research ( complementary research ) via secondary research companies , such as industry reports or analyses from large market research firms. These can help you gather preliminary information and inform your approach.

Step 3: Develop your research tools

Prior to working with participants, you’ll need to craft your survey or interview questions, interview guides, and other tools. These tools will help you capture the right information , weed out non-qualifying participants, and keep your information organized.

You should also have a system for recording responses to ensure data accuracy and privacy. Test your processes before speaking with participants so you can spot and fix inefficiencies or errors.

Step 4: Conduct the market research

With a system in place, you can start looking for candidates to contribute to your market research. This might include distributing surveys to current customers or recruiting participants who fit a specific profile, for example.

Set a time frame for conducting your research. You might collect responses over the course of a few days, weeks, or even months. If you’re using AI tools to gather data, choose a data range for your data to focus on the most relevant information.

Step 5: Analyze and apply your findings

Review your findings while looking for trends and patterns. AI tools can come in handy in this phase by analyzing large amounts of data on your behalf.

Compile your findings into an easy-to-read report and highlight key takeaways and next steps. Reports aren’t useful unless the reader can understand and act on them.

Tip: Learn more about trend forecasting , trend detection , and trendspotting .

Meltwater’s Radarly consumer intelligence suite helps you reap the benefits of market research on an ongoing basis. Using a combination of AI, data science, and market research expertise, Radarly scans multiple global data sources to learn what people are talking about, the actions they’re taking, and how they’re feeling about specific brands.

Our tools are created by market research experts and designed to help researchers uncover what they want to know (and what they don’t know they want to know). Get data-driven insights at scale with information that’s always relevant, always accurate, and always tailored to your organization’s needs.

Learn more when you request a demo by filling out the form below:

Continue Reading

What Are Consumer Insights? Meaning, Examples, Strategy

How Coca-Cola Collects Consumer Insights

Market Intelligence 101: What It Is & How To Use It

9 Top Consumer Insights Tools & Companies

Three-Day LIVE Summit with 10+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research