How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

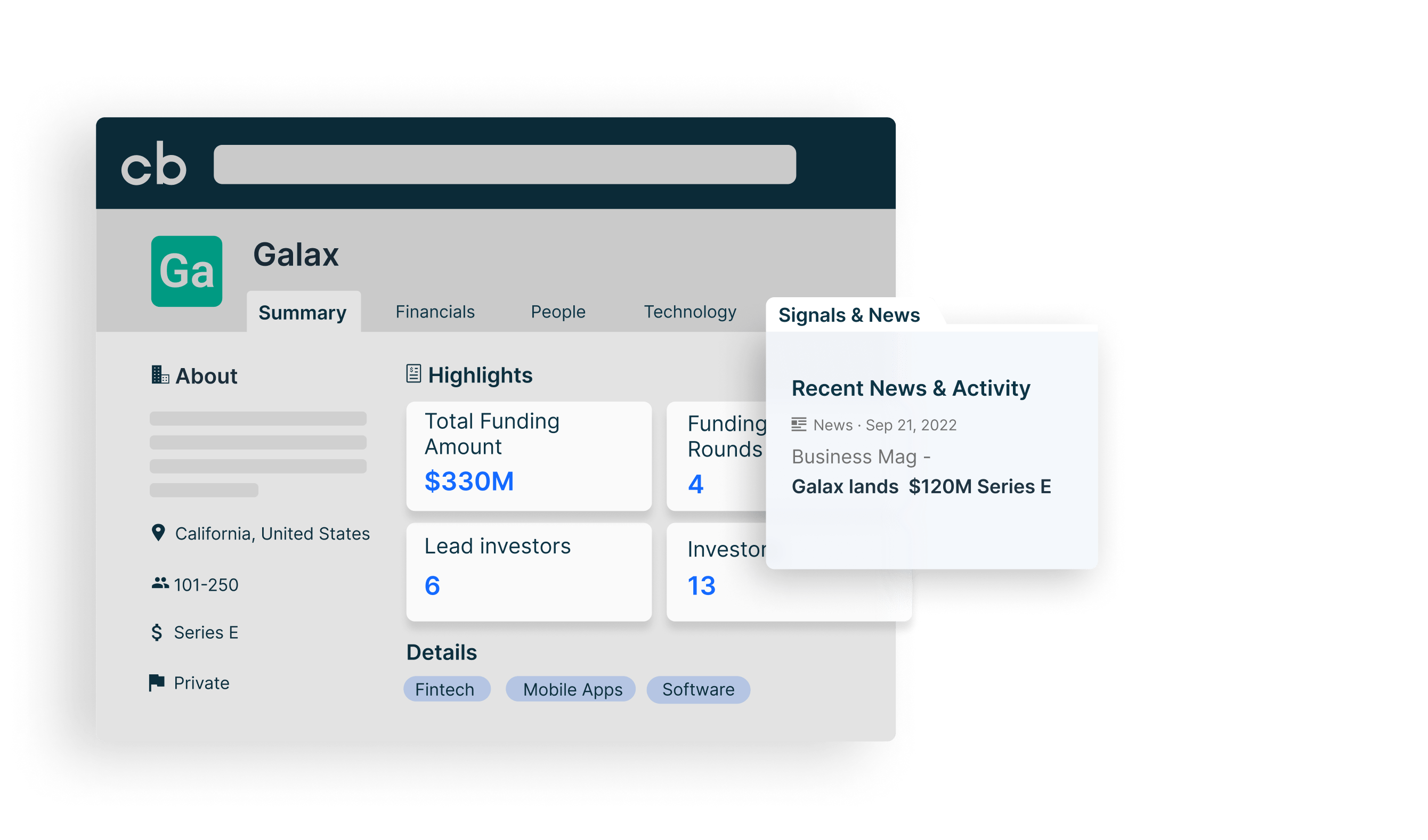

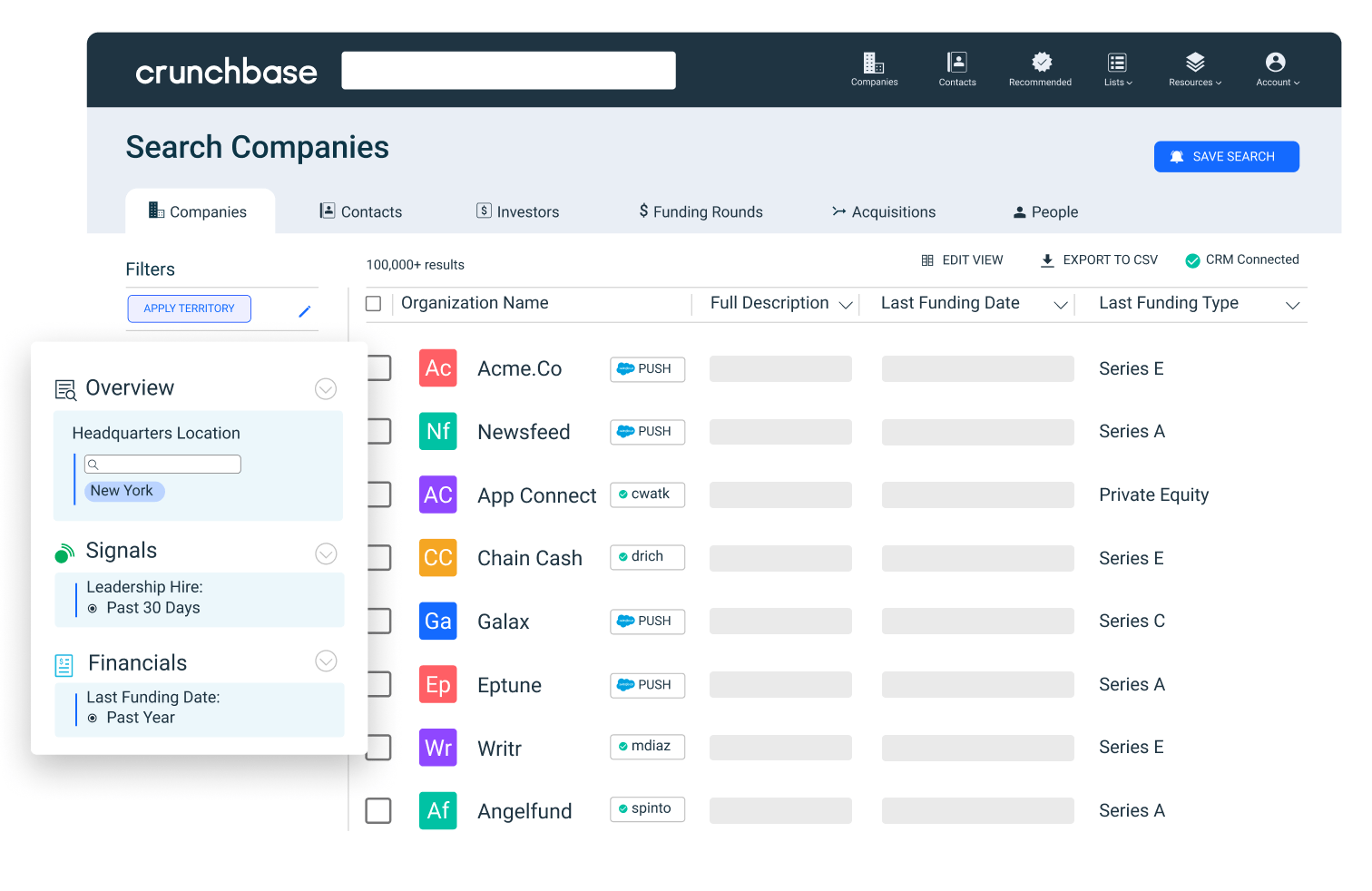

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Handbook of Market Research

- Reference work

- © 2022

- Christian Homburg 0 ,

- Martin Klarmann 1 ,

- Arnd Vomberg 2

Department of Business-to-Business Marketing, Sales, and Pricing, University of Mannheim, Mannheim, Germany

You can also search for this editor in PubMed Google Scholar

Department of Marketing & Sales Research Group, Karlsruhe Institute of Technology (KIT), Karlsruhe, Germany

Marketing & Sales Department, University of Mannheim, Mannheim, Germany

Guides through the state-of-the-art quantitative and qualitative market research methods

Provides an intuitive understanding of the material

Includes clear application examples for relevant topics

254k Accesses

283 Citations

6 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

About this book

Similar content being viewed by others.

Panel Data Analysis: A Nontechnical Introduction for Marketing Researchers

Market Research

- Data Analytics

- Marekt Research Methods

- Neural Networks

- Qualitative Market Research

- Survey Design

Table of contents (31 entries)

Front matter, experiments in market research.

- Torsten Bornemann, Stefan Hattula

Field Experiments

- Veronica Valli, Florian Stahl, Elea McDonnell Feit

Crafting Survey Research: A Systematic Process for Conducting Survey Research

- Arnd Vomberg, Martin Klarmann

Challenges in Conducting International Market Research

- Andreas Engelen, Monika Engelen, C. Samuel Craig

Fusion Modeling

- Elea McDonnell Feit, Eric T. Bradlow

Dealing with Endogeneity: A Nontechnical Guide for Marketing Researchers

- P. Ebbes, D. Papies, H. J. van Heerde

Cluster Analysis in Marketing Research

- Thomas Reutterer, Daniel Dan

Finite Mixture Models

- Sonja Gensler

Analysis of Variance

- Jan R. Landwehr

Regression Analysis

- Bernd Skiera, Jochen Reiner, Sönke Albers

Logistic Regression and Discriminant Analysis

- Sebastian Tillmanns, Manfred Krafft

Multilevel Modeling

- Till Haumann, Roland Kassemeier, Jan Wieseke

Panel Data Analysis: A Non-technical Introduction for Marketing Researchers

- Arnd Vomberg, Simone Wies

Applied Time-Series Analysis in Marketing

- Wanxin Wang, Gokhan Yildirim

Modeling Marketing Dynamics Using Vector Autoregressive (VAR) Models

- Shuba Srinivasan

Structural Equation Modeling

- Hans Baumgartner, Bert Weijters

Partial Least Squares Structural Equation Modeling

- Marko Sarstedt, Christian M. Ringle, Joseph F. Hair

Editors and Affiliations

Christian Homburg

Department of Marketing & Sales Research Group, Karlsruhe Institute of Technology (KIT), Karlsruhe, Germany

Martin Klarmann

Marketing & Sales Department, University of Mannheim, Mannheim, Germany

Arnd Vomberg

About the editors

Prof. Arnd Vomberg is Professor of Digital Marketing and Marketing Transformation at the University of Mannheim, Germany. Professor Vomberg has also been an Associate Professor (with tenure) at the Marketing Department of the University of Groningen, The Netherlands. Professor Vomberg’s research focuses on digital marketing and marketing transformation. He studies omnichannel strategies, online pricing, marketing automation, agile transformation, marketing technology, and marketing’s impact on employees. His research has been published in several leading journals of the field, including Journal of Marketing, Journal of Marketing Research, Strategic Management Journal, Journal of the Academy of Marketing Science, and International Journal of Research in Marketing. Professor Vomberg has received several awards for his research, including the Ralph Alexander Best Dissertation Award from the Academy of Management.

Bibliographic Information

Book Title : Handbook of Market Research

Editors : Christian Homburg, Martin Klarmann, Arnd Vomberg

DOI : https://doi.org/10.1007/978-3-319-57413-4

Publisher : Springer Cham

eBook Packages : Business and Management , Reference Module Humanities and Social Sciences , Reference Module Business, Economics and Social Sciences

Copyright Information : Springer Nature Switzerland AG 2022

Hardcover ISBN : 978-3-319-57411-0 Published: 03 December 2021

eBook ISBN : 978-3-319-57413-4 Published: 02 December 2021

Edition Number : 1

Number of Pages : XX, 1112

Number of Illustrations : 138 b/w illustrations, 73 illustrations in colour

Topics : Market Research/Competitive Intelligence , Sales/Distribution , Business Strategy/Leadership , Organization

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Skip to main content

- Skip to primary sidebar

Additional menu

Home Tools Customer Interview Questions to Conduct Market Research (Download PDF)

Customer Interview Questions to Conduct Market Research (Download PDF)

February 22, 2022

How do you determine if you have customers who will positively impact your product, relationships, and overall growth?

Do you know the people who are actually valuable to your brand?

2022 consumers face thousands of daily choices every single day. New products, new features, more bang for your buck…making each of those decisions takes its toll. This intensely competitive market justifies why tech companies are often too involved in investing in new technologies, products, and services.

While adding value to the consumer and aiming to capture a bigger market share isn’t a bad idea, risking missing out on the consumer journey, their needs, and wants can result in big opportunities being wasted.

Jump to the market research template.

Why Conduct Market Research?

There are three core stages critical to tech providers’ success – acquiring customers, retaining customers, and monetizing customers.

Companies who can determine:

- The most compelling reasons why their buyers decided to invest in their solution.

- The results they expect to achieve.

- The risks involved they understand with achieving the results.

- The concerns that cause your buyer to believe that your solution is not their best option.

- The surrounding influences to make a decision, as buyers rarely make them in isolation.

- The emotions and motivations behind making the buying decision.

Can create experience-driven marketing associated with guaranteed customer success.

You want to hear your buyer’s story and get into their heads. It clearly reveals the decision you need to influence showing you exactly how, when and why buyers engage to choose your solution, your competitors’, or stick with what they have.

The better the market research, the more dramatic the insights, and the more laser-focused targeting messaging, positioning, and value proposition are.

The Four Common Types of Market Research

There are multiple ways to conduct market research and collect customer data, test products, and do brand research, but the four most common are:

- Focus groups

- Observation

A form of qualitative research with open or closed-ended questions.

2- Focus groups

These offer deeper insight into the products’ customer experience and what marketing messages really resonate with them.

3- Observation

It has no predefined set of questions, so the challenge here is that you can’t get direct feedback from the user. It’s best when combined with interviews, surveys, and/or focus groups.

4- Interviews

Interviews allow for face-to-face discussions (in-person/ virtual), an excellent way for more natural conversations and deeper insights.

It is no secret that the deeper you dive into the problem, the clearer the solution becomes. But what better way to get into your ideal customer’s head, understand their pain points and needs, get inspiration for product development , learn their vocabulary, and even identify new target audiences than a one-on-one, real-time conversation with them!

You might not be able to directly tune into your customer’s brains. But with the right kind of interview, you can get the next best thing.

What is a Market Research Template?

To build a great product, you have to understand the market you’re targeting deeply. Otherwise, you could end up with a brilliant product that nobody wants. That’s where the market research template comes in, also known as a market study template. It can be a market research report template, market research survey template, market research excel template, or even a customer interview checklist.

It is a pre-built set of questions that will help you identify exactly who your buyers are, what they want, where they usually look for products, and how much they are willing to pay. Learn how you can get the market research template in action with our guide to B2B market research .

Market Research Template for Beginners

To help remove the complexity of the task and empower you to get more from your data, we’ve created a Customer Interview Questions Checklist.

Get started on your market research journey with our free interview tool with 21 open-ended questions so you can make the most of customer interviews. The meaty responses that these questions can provide will help you identify what is and is not working with your product for future improvements.

Download The Customer Interview Questions Checklist for Conducting Market Research

Related Content

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

Published: August 08, 2024

One of the most underrated skills you can have as a marketer is marketing research — which is great news for this unapologetic cyber sleuth.

From brand design and product development to buyer personas and competitive analysis, I’ve researched a number of initiatives in my decade-long marketing career.

And let me tell you: having the right marketing research methods in your toolbox is a must.

Market research is the secret to crafting a strategy that will truly help you accomplish your goals. The good news is there is no shortage of options.

How to Choose a Marketing Research Method

Thanks to the Internet, we have more marketing research (or market research) methods at our fingertips than ever, but they’re not all created equal. Let’s quickly go over how to choose the right one.

.png)

Free Market Research Kit

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

1. Identify your objective.

What are you researching? Do you need to understand your audience better? How about your competition? Or maybe you want to know more about your customer’s feelings about a specific product.

Before starting your research, take some time to identify precisely what you’re looking for. This could be a goal you want to reach, a problem you need to solve, or a question you need to answer.

For example, an objective may be as foundational as understanding your ideal customer better to create new buyer personas for your marketing agency (pause for flashbacks to my former life).

Or if you’re an organic sode company, it could be trying to learn what flavors people are craving.

2. Determine what type of data and research you need.

Next, determine what data type will best answer the problems or questions you identified. There are primarily two types: qualitative and quantitative. (Sound familiar, right?)

- Qualitative Data is non-numerical information, like subjective characteristics, opinions, and feelings. It’s pretty open to interpretation and descriptive, but it’s also harder to measure. This type of data can be collected through interviews, observations, and open-ended questions.

- Quantitative Data , on the other hand, is numerical information, such as quantities, sizes, amounts, or percentages. It’s measurable and usually pretty hard to argue with, coming from a reputable source. It can be derived through surveys, experiments, or statistical analysis.

Understanding the differences between qualitative and quantitative data will help you pinpoint which research methods will yield the desired results.

For instance, thinking of our earlier examples, qualitative data would usually be best suited for buyer personas, while quantitative data is more useful for the soda flavors.

However, truth be told, the two really work together.

Qualitative conclusions are usually drawn from quantitative, numerical data. So, you’ll likely need both to get the complete picture of your subject.

For example, if your quantitative data says 70% of people are Team Black and only 30% are Team Green — Shout out to my fellow House of the Dragon fans — your qualitative data will say people support Black more than Green.

(As they should.)

Primary Research vs Secondary Research

You’ll also want to understand the difference between primary and secondary research.

Primary research involves collecting new, original data directly from the source (say, your target market). In other words, it’s information gathered first-hand that wasn’t found elsewhere.

Some examples include conducting experiments, surveys, interviews, observations, or focus groups.

Meanwhile, secondary research is the analysis and interpretation of existing data collected from others. Think of this like what we used to do for school projects: We would read a book, scour the internet, or pull insights from others to work from.

So, which is better?

Personally, I say any research is good research, but if you have the time and resources, primary research is hard to top. With it, you don’t have to worry about your source's credibility or how relevant it is to your specific objective.

You are in full control and best equipped to get the reliable information you need.

3. Put it all together.

Once you know your objective and what kind of data you want, you’re ready to select your marketing research method.

For instance, let’s say you’re a restaurant trying to see how attendees felt about the Speed Dating event you hosted last week.

You shouldn’t run a field experiment or download a third-party report on speed dating events; those would be useless to you. You need to conduct a survey that allows you to ask pointed questions about the event.

This would yield both qualitative and quantitative data you can use to improve and bring together more love birds next time around.

Best Market Research Methods for 2024

Now that you know what you’re looking for in a marketing research method, let’s dive into the best options.

Note: According to HubSpot’s 2024 State of Marketing report, understanding customers and their needs is one of the biggest challenges facing marketers today. The options we discuss are great consumer research methodologies , but they can also be used for other areas.

Primary Research

1. interviews.

Interviews are a form of primary research where you ask people specific questions about a topic or theme. They typically deliver qualitative information.

I’ve conducted many interviews for marketing purposes, but I’ve also done many for journalistic purposes, like this profile on comedian Zarna Garg . There’s no better way to gather candid, open-ended insights in my book, but that doesn’t mean they’re a cure-all.

What I like: Real-time conversations allow you to ask different questions if you’re not getting the information you need. They also push interviewees to respond quickly, which can result in more authentic answers.

What I dislike: They can be time-consuming and harder to measure (read: get quantitative data) unless you ask pointed yes or no questions.

Best for: Creating buyer personas or getting feedback on customer experience, a product, or content.

2. Focus Groups

Focus groups are similar to conducting interviews but on a larger scale.

In marketing and business, this typically means getting a small group together in a room (or Zoom), asking them questions about various topics you are researching. You record and/or observe their responses to then take action.

They are ideal for collecting long-form, open-ended feedback, and subjective opinions.

One well-known focus group you may remember was run by Domino’s Pizza in 2009 .

After poor ratings and dropping over $100 million in revenue, the brand conducted focus groups with real customers to learn where they could have done better.

It was met with comments like “worst excuse for pizza I’ve ever had” and “the crust tastes like cardboard.” But rather than running from the tough love, it took the hit and completely overhauled its recipes.

The team admitted their missteps and returned to the market with better food and a campaign detailing their “Pizza Turn Around.”

The result? The brand won a ton of praise for its willingness to take feedback, efforts to do right by its consumers, and clever campaign. But, most importantly, revenue for Domino’s rose by 14.3% over the previous year.

The brand continues to conduct focus groups and share real footage from them in its promotion:

What I like: Similar to interviewing, you can dig deeper and pivot as needed due to the real-time nature. They’re personal and detailed.

What I dislike: Once again, they can be time-consuming and make it difficult to get quantitative data. There is also a chance some participants may overshadow others.

Best for: Product research or development

Pro tip: Need help planning your focus group? Our free Market Research Kit includes a handy template to start organizing your thoughts in addition to a SWOT Analysis Template, Survey Template, Focus Group Template, Presentation Template, Five Forces Industry Analysis Template, and an instructional guide for all of them. Download yours here now.

3. Surveys or Polls

Surveys are a form of primary research where individuals are asked a collection of questions. It can take many different forms.

They could be in person, over the phone or video call, by email, via an online form, or even on social media. Questions can be also open-ended or closed to deliver qualitative or quantitative information.

A great example of a close-ended survey is HubSpot’s annual State of Marketing .

In the State of Marketing, HubSpot asks marketing professionals from around the world a series of multiple-choice questions to gather data on the state of the marketing industry and to identify trends.

The survey covers various topics related to marketing strategies, tactics, tools, and challenges that marketers face. It aims to provide benchmarks to help you make informed decisions about your marketing.

It also helps us understand where our customers’ heads are so we can better evolve our products to meet their needs.

Apple is no stranger to surveys, either.

In 2011, the tech giant launched Apple Customer Pulse , which it described as “an online community of Apple product users who provide input on a variety of subjects and issues concerning Apple.”

"For example, we did a large voluntary survey of email subscribers and top readers a few years back."

While these readers gave us a long list of topics, formats, or content types they wanted to see, they sometimes engaged more with content types they didn’t select or favor as much on the surveys when we ran follow-up ‘in the wild’ tests, like A/B testing.”

Pepsi saw similar results when it ran its iconic field experiment, “The Pepsi Challenge” for the first time in 1975.

The beverage brand set up tables at malls, beaches, and other public locations and ran a blindfolded taste test. Shoppers were given two cups of soda, one containing Pepsi, the other Coca-Cola (Pepsi’s biggest competitor). They were then asked to taste both and report which they preferred.

People overwhelmingly preferred Pepsi, and the brand has repeated the experiment multiple times over the years to the same results.

What I like: It yields qualitative and quantitative data and can make for engaging marketing content, especially in the digital age.

What I dislike: It can be very time-consuming. And, if you’re not careful, there is a high risk for scientific error.

Best for: Product testing and competitive analysis

Pro tip: " Don’t make critical business decisions off of just one data set," advises Pamela Bump. "Use the survey, competitive intelligence, external data, or even a focus group to give you one layer of ideas or a short-list for improvements or solutions to test. Then gather your own fresh data to test in an experiment or trial and better refine your data-backed strategy."

Secondary Research

8. public domain or third-party research.

While original data is always a plus, there are plenty of external resources you can access online and even at a library when you’re limited on time or resources.

Some reputable resources you can use include:

- Pew Research Center

- McKinley Global Institute

- Relevant Global or Government Organizations (i.e United Nations or NASA)

It’s also smart to turn to reputable organizations that are specific to your industry or field. For instance, if you’re a gardening or landscaping company, you may want to pull statistics from the Environmental Protection Agency (EPA).

If you’re a digital marketing agency, you could look to Google Research or HubSpot Research . (Hey, I know them!)

What I like: You can save time on gathering data and spend more time on analyzing. You can also rest assured the data is from a source you trust.

What I dislike: You may not find data specific to your needs.

Best for: Companies under a time or resource crunch, adding factual support to content

Pro tip: Fellow HubSpotter Iskiev suggests using third-party data to inspire your original research. “Sometimes, I use public third-party data for ideas and inspiration. Once I have written my survey and gotten all my ideas out, I read similar reports from other sources and usually end up with useful additions for my own research.”

9. Buy Research

If the data you need isn’t available publicly and you can’t do your own market research, you can also buy some. There are many reputable analytics companies that offer subscriptions to access their data. Statista is one of my favorites, but there’s also Euromonitor , Mintel , and BCC Research .

What I like: Same as public domain research

What I dislike: You may not find data specific to your needs. It also adds to your expenses.

Best for: Companies under a time or resource crunch or adding factual support to content

Which marketing research method should you use?

You’re not going to like my answer, but “it depends.” The best marketing research method for you will depend on your objective and data needs, but also your budget and timeline.

My advice? Aim for a mix of quantitative and qualitative data. If you can do your own original research, awesome. But if not, don’t beat yourself up. Lean into free or low-cost tools . You could do primary research for qualitative data, then tap public sources for quantitative data. Or perhaps the reverse is best for you.

Whatever your marketing research method mix, take the time to think it through and ensure you’re left with information that will truly help you achieve your goals.

Don't forget to share this post!

Related articles.

![how to do market research pdf SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

Market Research: A How-To Guide and Template

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![how to do market research pdf How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![how to do market research pdf 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Have questions about buying, selling or renting during COVID-19? Learn more

Zillow Research aims to be the most open, authoritative source for timely and accurate housing data and unbiased insight.

- Price Cuts Abound as Home Sellers See Inventory Piling Up (June 2024 Market Report)

The Numbers

JUNE 2024 U.S. Typical Home Value (Zillow Home Value Index)

$362,482 (3.2% YoY)

JUNE 2024 U.S. Typical Rent (Zillow Observed Rent Index)

$2,054 (3.5% YOY)

JUNE 2024 Change in New Listings

MAY 2024 Typical Mortgage Payment

- Luxury Home Values Are Rising Faster Than Typical Homes for the First Time in Years

- A $1 Million Starter Home is the Norm in 237 Cities

- Mortgage Rates Rebounded Slightly This Week Ahead of Key Inflation Report

- June 2024: New home Sales Fell Again Despite Easing Mortgage Rates

- June 2024 Existing Home Sales: Sales Fell as Buyers and Sellers Wait On The Sideline For An Improvement In Housing Affordability

- Zillow Home Value and Home Sales Forecast (June 2024)

- New U.S. Homes Are Now Cheaper by the Foot Than Existing Ones

- Mortgage Rates Fall As Slowing Economy And Fed Rate Cuts Weigh On The Mind Of Investors And Fed Officials

- June 2024 Housing Starts: Housing Starts Rebound in June, Single-Family Construction Slows Less Than Expected

IMAGES

VIDEO

COMMENTS

Charterhouse Research is pleased to bring you its Fundamentals of market research techniques guide. The book is intended to be a basic step-by-step guide to market research techniques, designed for new-to-research client-side research personnel. We are often asked by our clients if we can talk through some key

The structure of the market research industry. Market research is bought by companies to help market the goods and services they produce and by government organisations to assist policy making. It is estimated that the total spend on market research by UK companies and organisations is just over £1 billion per annum.

SWOT Analysis Template. A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis looks at your internal strengths and weaknesses, and your external opportunities and threats within the market. A SWOT analysis highlights direct areas of opportunity your company can continue, build, focus on, and work to overcome.

Conducting market research is a necessary step in the process of creating a top-notch marketing strategy. And, the good news is it doesn't have to be difficult. With a little bit of training and access to the right resources (like this guide), you can rest assured you and your market research team will create a winning market research strategy.

1. Discuss the basic types and functions of marketing research. 2. Identify marketing research studies that can be used in making marketing decisions. 3. Discuss how marketing research has evolved since 1879. 4. Describe the marketing research industry as it exists today. 5. Discuss the emerging trends in marketing research. INTRODUCTION

The market research process. 2.2 Identify and Formulate the Problem. The first step in setting up a market research process involves identifying and formulating the research problem. Identifying the research problem is valuable, but also dificult. To identify the "right" research problem, we should first identify the marketing symptoms or ...

Market research should be the primary driver of changes to your company's marketing mix - the combination of product, price, place and promotion. This is commonly referred to as 'the 4 Ps'. Using these components, you can put your business in the best possible position to reach your target market. 3 | P a g e.

According to the dictionary, the word 'research' means to search or investigate exhaustively or in detail. The thesaurus gives as a synonym for 'research' the word 'inquiry', which means the act of seeking truth, information or knowledge. So market research can be defined as a detailed search for the truth.

research. Possibly you have a market research project to complete and need help with how to go about it. You may be studying for a business degree and market research is part of your course. You may be taking the Market Research Society/City & Guilds Certificate in Market & Social Research. Whatever the case, I hope that the knowl-

6. Discuss the considerations involved in selecting marketing scales. 7. Explain ways researchers can ensure the reliability and validity of scales. Introduction . Marketing scales are used extensively by marketing researchers to measure a wide array of beliefs, attitudes, and behaviors.

Example 2: McDonald's global expansion. McDonald's successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald's conducts thorough research to understand local tastes, preferences and cultural nuances.

V. Kumar. 1) a broad and comprehensive understanding, including usefulness and pitfalls, of all the market research techniques of data gathering and analysis; 2) a process of conducting research that will ensure the proper conceptualization, execution and usage of research; 3) ideas for structuring the market research department such that ...

In this handbook, internationally renowned scholars outline the current state-of-the-art of quantitative and qualitative market research. They discuss focal approaches to market research and guide students and practitioners in their real-life applications. Aspects covered include topics on data-related issues, methods, and applications.

MARKET RESEARCH. T. he first step in planning a market research study is to spend some time identifying and articulating the underlying decision problem that makes a research study seem necessary. The importance of this initial step cannot be over emphasized. The more secure the researcher's grasp of the decision problem, the greater the ...

Abstract. This is the fifth edition of Marketing Research and the first that also takes a United Kingdom, European perspective. It continues to reflect the importance of social media, 'big data ...

Marketing research is the process of collecting, analyzing, and reporting marketing. that can be. used to answer questions or solve problems so as to imp. ove. a company'sbottom line. Marketing research inc. udes a wide range of activities. (Bycontra. t, market research is a narrower activity.

Market research information can be used to shape the acquisition strategy, to determine the type and content of the product description or statement of work, and to develop the support strategy, the terms and conditions included in the contract, and the evaluation factors used for

for market research only arises at specific points in time. No decision looming, or no ability to identify a decision, and/or no information gap indicates no opportunity or need for market research. As a businessperson, you don't do market research because it's a virtuous practice; you do it when and if it prom - ises a payoff.

There are multiple ways to conduct market research and collect customer data, test products, and do brand research, but the four most common are: Surveys. Focus groups. Observation. Interviews. 1- Surveys. A form of qualitative research with open or closed-ended questions. 2- Focus groups.

Use competitive analysis to find a market advantage. Competitive analysis helps you learn from businesses competing for your potential customers. This is key to defining a competitive edge that creates sustainable revenue. Your competitive analysis should identify your competition by product line or service and market segment.

The Guide assists a Multifunctional Team (MFT)1in preparing market research supporting the acquisition of services. The Guide's intent is not to provide comprehensive information on the subject of market research, but rather to offer a common framework for conducting and documenting research. When completed, the market research report ...

2 1 Introduction to Market Research. of data collection, collecting the data, analyzing the data, interpreting, discussing, and presenting the findings, and ending with the follow-up. Some people ...

3. When to conduct market research Market research is widely viewed as a component of the planning stage of a business. Indeed, market research is critical for new start-ups and should be a key element of any entrepreneur's business plan. Market research data feeds into a number of areas of the business plan, contributing to sections on:

If you'd like more information on how specific market research tools deliver information relevant to your lead generation/conversion goals, send your question(s) to Linda Kuster, [email protected] or call (319) 364-7278. We enjoy discussing market research application to your business needs. No obligation. Need help with your

Best Market Research Methods for 2024. Now that you know what you're looking for in a marketing research method, let's dive into the best options. Note: According to HubSpot's 2024 State of Marketing report, understanding customers and their needs is one of the biggest challenges facing marketers today.

Zillow Research aims to be the most open, authoritative source for timely and accurate housing data and unbiased insight. ... Price Cuts Abound as Home Sellers See Inventory Piling Up (June 2024 Market Report) The Numbers JUNE 2024 U.S. Typical Home Value (Zillow Home Value Index) $362,482 (3.2% YoY) JUNE 2024 U.S. Typical Rent (Zillow Observed ...

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other