- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : July 24, 2024 at 12:10 PM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

Assignment of Membership Interest Template

Legal GPS templates are drafted by top startup attorneys and fully customizable.

Table of Contents

Necessary approvals and consent, impact on ownership, voting, and profit rights, complete assignment, partial assignment.

- Key elements to include

Step 1: Gather Relevant Information

Step 2: review the llc's operating agreement, step 3: obtain necessary approvals and consents, step 4: outline the membership interest being transferred, step 5: determine the effective date of the assignment, step 6: specify conditions and representations, step 7: address tax and liability issues, step 8: draft the entire agreement and governing law clauses, step 9: review and sign the assignment agreement.

- Advantages of using a professionally-created template

- How our contract templates stand out from the rest

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

Do you need a lawyer for this, what is an assignment of membership interest.

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

Legal GPS Subscription

Protect your business with our complete legal subscription service, designed by top startup attorneys.

- ✅ Complete Legal Toolkit

- ✅ 100+ Editable Contracts

- ✅ Affordable Legal Guidance

- ✅ Custom Legal Status Report

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

|

|

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

Get Your Assignment of Membership Interest Template with a Legal GPS Subscription

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

Get Legal GPS's Assignment of Membership Interest Template Now

Understanding the Membership Interest Purchase Agreement for Single Owners

Welcome to another of our informative blog posts aimed at demystifying complex legal topics. Today, we're addressing something that many solo...

Why Your Company Absolutely Needs a Membership Interest Pledge Agreement

When it comes to running a business, it's essential to cover all your bases to ensure the smooth operation of your company and the protection of your...

Why Every Company Needs a Media Consent and Release Form

Picture this: you’re a business owner, and you’ve just wrapped up a fantastic marketing campaign featuring your clients’ success stories. You're...

Avoiding the Pitfalls of Assigning an Interest in an LLC

Author(s) Brian M. Gillett

One of the goals in a business divorce is finality – ending a business relationship once and for all. But what if the end isn’t really the end?

When members of limited liability companies (LLCs) sell their interests in the LLCs to a third party, they may assume that the sale provides the desired end of their rights and obligations related to the company. But that may not be the case. It is possible that even after selling and assigning an LLC interest, the assignor may continue to owe fiduciary duties to the LLC and its members. This post reviews some of the pitfalls of assigning an LLC interest and discusses strategies that may help to avoid those problems.

The Texas LLC Act – Provisions Governing Assignments of LLC Interests

Chapter 101 of the Texas Business Organizations Code (the “LLC Act”) governs LLCs. The LLC Act provides that a member of an LLC may transfer his or her membership interest to another party in whole or in part. But the assignment of an LLC interest is different from the transfer of membership in the company. The assignment of the LLC interest does not give the assignee the rights to (1) participate in the management and affairs of the company; (2) become a member of the company; or (3) exercise any rights of a member of the company. The assignment of the LLC interest provides the assignee with the right to receive distributions issued by the company and information about the company’s finances, but that’s about it.

The LLC Act spells out these rights of the assignee: “An assignor of a membership interest in a limited liability company continues to be a member of the company until the assignee becomes a member of the company.” Further, the assignor does not have the right under the LLC Act to withdraw as a member from the company. (An LLC member also cannot be expelled from the company.) The result is that even after assignors assign the LLC interest and are enjoying “life on the beach,” they may still owe fiduciary duties as a member of the company.

As a side note, this discussion has assumed that there are fiduciary duties owed within the LLC at issue. But that is not always the case. The LLC Act permits the members to agree in the company’s certificate of formation or operating agreement to modify or even eliminate all fiduciary duties that are owed to the company and its members by the managers of the LLC. Tex. Bus. Org. Code § 7.001(d)(3). While including such a provision would certainly make it safer for a member to assign an LLC interest, doing so poses its own set of risks while the company is operating.

A Case Study: Villareal v. Saenz

The problem of fiduciary duties persisting after an assignment may sound far-fetched, but it is a real concern. In Villareal v. Saenz , the co-owners of an LLC agreed to a business divorce in which Saenz assigned the entirety of his interest in the company to Villareal. 5:20-cv-571, 2021 WL 1986831, at *2 (W.D. Tex. May 18, 2021). The assignment was part of a broad release of claims, both known and unknown. Villareal later filed suit, alleging that before signing the release, Saenz had engaged in various acts of misconduct, including misappropriating company trade secrets and embezzling funds, and that after the release, Saenz had taken over the company’s web and email domain, pulled down the website, and offered to sell it back to Villareal for $7,000.

A magistrate judge in the Western District of Texas recommended that all claims based on alleged acts arising before the release should be dismissed for failure to state a claim. But the magistrate judge also recommended that the claims against Saenz based on actions that allegedly took place after the release – including those for breach of fiduciary duty – should proceed. The court concluded that Saenz had not demonstrated that his fiduciary duties ended when he assigned his interest in the company to Villareal, and he may have breached those fiduciary duties by maintaining dominion and control over the company’s email server and website.

Conclusion and Recommendations

The key takeaway from Villareal v. Saenz is that disputes between owners regarding the fiduciary duties that exist after an assignment can be avoided by more clearly wording the company agreement or assignment. The following are specific steps that potential assignors can take before their assign their LLC interests to another party:

- First, assignors can make sure that the assignment provides an end to their membership in the company by agreement of all members, along with a mechanism set forth for the assignee to assume the membership interest.

- Second, assignors can include an express written release and waiver of any post-assignment duties to the company or its members (fiduciary or otherwise). This should be signed by the company and all of its members to be certain it is effective.

- Third, and most importantly, assignors can make sure at the outset, when forming the company, that the operating agreement provides a mechanism for transfer of the membership interest in connection with an assignment, specifying what happens to the member’s duties (fiduciary or otherwise) when the transfer takes place.

The bottom line is that when assignor is trying to exit the company, he or she does not want to have any continuing duties to the company. To ensure this takes place, the assignment documents and the terms of the LLC Agreement should confirm that these duties no longer exist after the assignment takes place.

- Business Divorce My Partner Just Sued Me: Strategies Majority Owners Should Consider in Defending Claims Filed by Private Company Investors

- Business Divorce The Intersection of Business in Marital Divorce Cases: Business Issues That Often Arise in Family Law Proceedings

- Business Divorce Opening Up the Business Partner Time Capsule: Partnership Lessons Shared by Owners and Investors

Trending News

Related Practices & Jurisdictions

- Corporate Business Organizations

- Administrative Regulatory

- Election Law Legislative News

- Litigation Trial Practice

- 5th Circuit (incl. bankruptcy)

One of the goals in a business divorce is finality – ending a business relationship once and for all. But what if the end isn’t really the end?

When members of limited liability companies (LLCs) sell their interests in the LLCs to a third party, they may assume that the sale provides the desired end of their rights and obligations related to the company. But that may not be the case. It is possible that even after selling and assigning an LLC interest, the assignor may continue to owe fiduciary duties to the LLC and its members. This post reviews some of the pitfalls of assigning an LLC interest and discusses strategies that may help to avoid those problems.

The Texas LLC Act – Provisions Governing Assignments of LLC Interests

Chapter 101 of the Texas Business Organizations Code (the “LLC Act”) governs LLCs. The LLC Act provides that a member of an LLC may transfer his or her membership interest to another party in whole or in part. But the assignment of an LLC interest is different from the transfer of membership in the company. The assignment of the LLC interest does not give the assignee the rights to (1) participate in the management and affairs of the company; (2) become a member of the company; or (3) exercise any rights of a member of the company. The assignment of the LLC interest provides the assignee with the right to receive distributions issued by the company and information about the company’s finances, but that’s about it.

The LLC Act spells out these rights of the assignee: “An assignor of a membership interest in a limited liability company continues to be a member of the company until the assignee becomes a member of the company.” Further, the assignor does not have the right under the LLC Act to withdraw as a member from the company. (An LLC member also cannot be expelled from the company.) The result is that even after assignors assign the LLC interest and are enjoying “life on the beach,” they may still owe fiduciary duties as a member of the company.

As a side note, this discussion has assumed that there are fiduciary duties owed within the LLC at issue. But that is not always the case. The LLC Act permits the members to agree in the company’s certificate of formation or operating agreement to modify or even eliminate all fiduciary duties that are owed to the company and its members by the managers of the LLC. Tex. Bus. Org. Code § 7.001(d)(3). While including such a provision would certainly make it safer for a member to assign an LLC interest, doing so poses its own set of risks while the company is operating.

A Case Study: Villareal v. Saenz

The problem of fiduciary duties persisting after an assignment may sound far-fetched, but it is a real concern. In Villareal v. Saenz , the co-owners of an LLC agreed to a business divorce in which Saenz assigned the entirety of his interest in the company to Villareal. 5:20-cv-571, 2021 WL 1986831, at *2 (W.D. Tex. May 18, 2021). The assignment was part of a broad release of claims, both known and unknown. Villareal later filed suit, alleging that before signing the release, Saenz had engaged in various acts of misconduct, including misappropriating company trade secrets and embezzling funds, and that after the release, Saenz had taken over the company’s web and email domain, pulled down the website, and offered to sell it back to Villareal for $7,000.

A magistrate judge in the Western District of Texas recommended that all claims based on alleged acts arising before the release should be dismissed for failure to state a claim. But the magistrate judge also recommended that the claims against Saenz based on actions that allegedly took place after the release – including those for breach of fiduciary duty – should proceed. The court concluded that Saenz had not demonstrated that his fiduciary duties ended when he assigned his interest in the company to Villareal, and he may have breached those fiduciary duties by maintaining dominion and control over the company’s email server and website.

Conclusion and Recommendations

The key takeaway from Villareal v. Saenz is that disputes between owners regarding the fiduciary duties that exist after an assignment can be avoided by more clearly wording the company agreement or assignment. The following are specific steps that potential assignors can take before their assign their LLC interests to another party:

First, assignors can make sure that the assignment provides an end to their membership in the company by agreement of all members, along with a mechanism set forth for the assignee to assume the membership interest.

Second, assignors can include an express written release and waiver of any post-assignment duties to the company or its members (fiduciary or otherwise). This should be signed by the company and all of its members to be certain it is effective.

Third, and most importantly, assignors can make sure at the outset, when forming the company, that the operating agreement provides a mechanism for transfer of the membership interest in connection with an assignment, specifying what happens to the member’s duties (fiduciary or otherwise) when the transfer takes place.

The bottom line is that when assignor is trying to exit the company, he or she does not want to have any continuing duties to the company. To ensure this takes place, the assignment documents and the terms of the LLC Agreement should confirm that these duties no longer exist after the assignment takes place.

Current Public Notices

Current legal analysis, more from bradley arant boult cummings llp, upcoming legal education events.

Sign Up for e-NewsBulletins

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

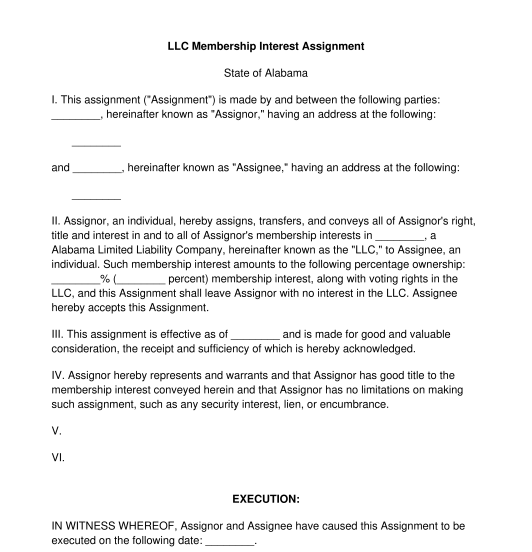

LLC Membership Interest Assignment

Rating: 4.8 - 952 votes

What is an LLC membership interest assignment?

An LLC membership interest assignment is a document used when one member of a limited liability company ("LLC") wishes to transfer the entirety of their interest in an LLC to another party . This document is often used when a member of an LLC is leaving or otherwise wants to give up the entirety of their interest in the company. Using this document, the current owner of shares in the LLC transfers all of them over to another person or entity.

A limited liability company , also known as an LLC, is a corporate structure that protects its owners from being personally liable for debts and liabilities of the company . LLCs do not pay taxes on their profits directly. Instead, profits and losses are passed through to the individual members, who report them on their personal tax returns.

What is the difference between an LLC membership interest assignment and an LLC membership purchase agreement?

Though both documents involve the transfer of interest in an LLC from one party to another, these two documents serve different purposes. The LLC membership interest assignment transfers the entirety of one person's interest in the LLC to another person. It is also not a sale document.

An LLC membership purchase agreement is the sale of some portion of a party's interest in an LLC to another party.For example, if someone owned 50% interest in an LLC, they could sell 25% of their interest in the LLC to another party and keep the remaining 25% interest for themselves.

Is it mandatory to use an LLC membership interest assignment?

Yes, using an LLC membership interest assignment is mandatory in most states. In the few states where it is not mandatory, it is still highly advisable to use this document to be sure to protect the interests of the parties involved and to make sure all the members of the LLC are informed about the ownership transfer.

What is "membership interest"?

Membership interest is a party's ownership stake in an LLC. It represents the parties' right to share in the profits and losses of the LLC and to receive distributions from it.

What must an LLC membership interest assignment contain?

A valid LLC membership interest assignment must contain at least the following mandatory clauses:

- Identification of involved parties : The LLC membership interest assignment will include details about the identity of both the party giving up their interest, as well as the party who will get the interest in the LLC.

- Description of membership interest : The LLC membership interest assignment includes details about the membership interest, including the percentage of the LLC and whether it includes voting rights.

In addition to the above mandatory clauses, the LLC membership interest assignment may also include the following optional clause:

- Consent requirement : If needed, this document includes an addendum at the end specifying that all the members of the LLC consent to the transfer of interest.

What are the prerequisites of an LLC membership interest assignment?

Prior to creating an LLC membership interest assignment, several things should happen. Firstly, the parties should review the LLC's operating agreement . This document may contain restrictions or requirements for the transfer of interest in the LLC. For example, the operating agreement may require that existing members of the LLC have the right to buy the interest in the LLC before it is sold to any outside third party.

The parties to the agreement should also get consent to the sale from the current members of the LLC. This is not always necessary, but it is common and usually considered good practice.

Before agreeing to the terms of the LLC membership interest assignment, the new owner should also do research into the LLC to be sure that it is in good standing and not involved in ongoing litigation or bankruptcy proceedings.

Who is involved in an LLC membership interest assignment?

The LLC membership interest assignment includes the party giving up their interest in an LLC and the party receiving the interest in the LLC. Both of these parties can either be individual people or entities, like a business or charitable organization.

What has to be done once the LLC membership assignment agreement is done?

Once the LLC membership interest assignment is done, it should be signed and dated both the assigning party and the receiving party . All members of the LLC should be notified of the transfer. This notification usually happens by providing a copy of the Assignment and any related documents to the LLC's registered agent or manager. Information about the process is typically specified in the LLC Operating Agreement . In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization. The LLC should be sure to update its bank accounts, contracts, licenses, and permits as necessary to reflect the membership change. Finally, the LLC should maintain accurate records of the transfer of interest, saving for future reference copies of the Assignment Agreement, amended Operating Agreement, consent of members, and any other relevant documents.

Is it necessary to register the LLC membership interest assignment?

In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization .

Which laws are applicable to an LLC membership interest assignment?

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents because each individual state governs the businesses formed within that state.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

LLC Membership Interest Assignment - FREE - Template

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Articles & Insights

Protecting your security interest in an llc membership interest: methods and considerations for perfecting.

By: Rochelle Hauser | September 18, 2018 Owning a Business

You have made the decision to provide financing, whether as a business owner or otherwise. Perhaps you are loaning money to a borrower, or selling a company you own and financing the purchase. You will likely require some type of collateral to secure repayment of the loan.

If your collateral includes a limited liability company (“LLC”) membership interest, there are important steps you need to follow to be sure you are protected in the transaction.

First, you need to review the organizational documents to determine whether the security interest in the membership interest is permitted. If not permitted, you need to obtain consent from the company and other members. Next, you will want to have a security agreement (often called a pledge agreement) granting you a security interest in the membership interest, signed by the borrower.

However, that’s only part of the process. You also need to “perfect” your security interest in the membership interest. Perfecting a security interest protects your rights in the collateral and determines your priority in relation to other creditors .

Perfection methods vary depending on the jurisdiction and the type of collateral. To determine the appropriate method to perfect your security interest in a membership interest, you must review the company’s organizational documents, as well as the Uniform Commercial Code (“UCC”) in the appropriate jurisdiction.

Methods for perfecting

General intangible : Most commonly, a membership interest in an LLC is considered a general intangible . To perfect a security interest in a general intangible, you must file a UCC-1 financing statement with the Secretary of State’s office in the state in which the individual resides, or in which the entity was formed, depending on whether the borrower is an individual or an entity.

Once you file the financing statement, your security interest is considered perfected. Generally, the timing of filing, among other factors, determines the order of priority among multiple secured parties, with the first to file having priority.

A financing statement lapses five years from the date of filing. If the loan will be longer than five years, you must file a UCC-3 continuation statement prior to the lapse date to maintain perfection. The continuation statement can be filed up to six months before the lapse date.

Security : An LLC, however, can elect to have its membership interests classified as securities under Article 8 of the UCC. Generally, the organizational documents must expressly state that the membership interests are to be treated as securities. Additionally, if the membership interests are certificated, they are also considered securities. As the secured party, you must review the organizational documents to determine whether the “opt in” language is included or the membership interests are certificated, to properly perfect your security interest.

If the membership interests are securities, then you perfect by taking possession or control of the securities – or both. If the membership interests are certificated, then you perfect by taking possession of the certificates and by taking control by having the security interest noted in the company’s records. If the membership interests are not certificated, then you perfect by taking control by entering into an agreement with the company that specifies the company will take instructions from you, the secured party, as well as having the security interest noted in the company’s records. In each case, the borrower will also give you an assignment of the membership interest so that you can transfer title if there is a default on the loan.

Note: You can also perfect by filing a UCC-1 financing statement. However, possession or control take priority over a UCC-1 filing, so they are better forms of protection.

Considerations after perfecting

After you have perfected your security interest, a company can amend its organizational documents to either opt in or opt out of Article 8, or to certificate or uncertificate its membership interests. If that occurs, the method of perfection could change, and your priority could be jeopardized.

As the secured party, you can protect your security interest as follows:

- Obtain a written commitment from the company that it will not alter the current status, whether it is opted in to or opted out of Article 8, until you are paid back your loan.

- Obtain a written commitment from the company that it will not change the membership interests from certificated to uncertificated, or vice versa, until you are paid back your loan.

- If the company has opted in to Article 8, request that the company provide certificates for its membership interests and then take possession of the certificates.

- Depending on the situation, you also may choose to file a financing statement, take possession of any certificates, and get the appropriate agreements and actions from the company.

Because of the complexity and varying factors involved in obtaining and perfecting a security interest, lenders should consider consulting with an attorney who can assist them with reviewing the organizational documents and properly obtaining and perfecting their security interest.

At Henson Efron, our attorneys have extensive experience assisting secured parties in protecting their collateral. If you’d like to learn more about how our experience and knowledge can help protect your business, please contact Henson Efron .

The purpose of this article is merely to provide general information and should not be construed as legal advice.

Who Are You?

- Business Law

- Estate, Trust and Probate

- Real Estate

- Netlink Alliance

- Awards & Honors

- Thought Leadership

LLC Membership Interests as Collateral

It is not uncommon for lenders to take a security interest in a business owner’s ownership interest in the corporation, LLC, limited partnership or other entity as collateral for a loan to the business. For the most part, the transactions are documented through a standard pledge or assignment (the “assignment agreement”) of the stock or other evidence of ownership. While such an approach may be acceptable when the interests of a corporation are pledged, when the collateral is an interest in an LLC, savvy lenders will make sure that they use an enhanced form of assignment agreement and perhaps obtain the consents (and necessary waivers) from the other LLC members.

An enhanced form of assignment agreement is called for because an LLC has one distinct advantage over other entity forms. Under Maryland law, a judgment against an LLC member can only be enforced by imposing a charging order against the member’s interest. This is a court order requiring the LLC to pay the creditor the debtor member’s share of LLC distributions. In this respect, a charging order is akin to a wage garnishment, except it is against the member’s distributions rather than against wages. The lender who simply obtains an assignment of a membership interest in an LLC gets no right to attach the member’s LLC interest or be admitted as a voting member . The lender cannot, therefore, participate in company management, force a sale of company assets or distribution of profits, or inspect company books.

In contrast, shares of a corporation’s stock are freely transferable absent contrary provisions in a shareholder agreement. Consequently, a lender with a security interest can typically exercise all of the associated rights of a stockholder. Upon obtaining the shares, the lender acquires the right to inspect corporate books and records and to vote on the election and removal of directors. If the shares represent a controlling interest, the lender could actually replace all the directors and officers and take over control of the corporation. Depending on the circumstances, the lender may also have the right to seek involuntary dissolution or place the corporation in receivership.

To optimize the collateral value of an LLC membership interest, lenders will want to be sure that they, as assignees, can be admitted, automatically, as full voting members of the company once they obtain ownership of the membership interest (a complex process in and of itself). Lenders will also want to scrutinize the LLC operating agreement to see if it contains provisions that either permit the company to acquire a member’s interest for a discounted value in the event of the member’s personal bankruptcy or that limit profit distributions either by making them discretionary rather than mandatory, or by restricting distributions to insolvent members. Finally, the operating agreement should be reviewed so that the lender understands any restrictions that may be placed upon the rights of an assignee who assumes a member’s interest. If such provisions are included in the operating agreement, they should be addressed in the assignment agreement as part of the negotiations over the assignment of the LLC membership interest so as to preserve the creditor’s rights and the value of charging orders.

Savvy lenders know that the LLC is the optimal form of entity for insulating company assets from owners’ personal creditors. Hence, they are the lenders that will carefully review the LLC organizational documents and only take LLC interests as collateral using an enhanced form of assignment agreement.

- Privacy Overview

- Strictly Necessary Cookies

- Cookie Policy

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

More information about our Cookie Policy

MEMBERSHIP PROGRAMS

- Law.com Pro

- Law.com Pro Mid-Market

- Global Leaders In Law

- Global Leaders In Law Advisers

- Private Client Global Elite

MEDIA BRANDS

- Law.com Radar

- American Lawyer

- Corporate Counsel

- National Law Journal

- Legal Tech News

- New York Law Journal

- The Legal Intelligencer

- The Recorder

- Connecticut Law Tribune

- Daily Business Review

- Daily Report

- Delaware Business Court Insider

- Delaware Law Weekly

New Jersey Law Journal

- Texas Lawyer

- Supreme Court Brief

- Litigation Daily

- Deals & Transactions

- Law Firm Management

- Legal Practice Management

- Legal Technology

- Intellectual Property

- Cybersecurity

- Law Journal Newsletters

- Analyst Reports

- Diversity Scorecard

- Kirkland & Ellis

- Latham & Watkins

- Baker McKenzie

- Verdict Search

- Law.com Compass

- China Law & Practice

- Insurance Coverage Law Center

- Law Journal Press

- Lean Adviser Legal

- Legal Dictionary

- Law Catalog

- Expert Witness Search

- Recruiters Directory

- Editorial Calendar

Legal Newswire

- Lawyer Pages

- Law Schools

- Women in Influence (WIPL)

- GC Profiles

- How I Made It

- Instant Insights

- Special Reports

- Resource Center

- LMA Member Benefits

- Legal Leaders

- Trailblazers

- Expert Perspectives

- Lawjobs.com

- Book Center

- Professional Announcements

- Asset & Logo Licensing

Content Source

Content Type

About Us | Contact Us | Site Map

Advertise | Customer Service | Terms of Service

FAQ | Privacy Policy

Copyright © 2021 ALM Global, LLC.

All Rights Reserved.

- Law Topics Litigation Transactional Law Law Firm Management Law Practice Management Legal Technology Intellectual Property Cybersecurity Browse All ›

- Surveys & Rankings Amlaw 100 Amlaw 200 Global 200 NLJ 500 A-List Diversity Scorecard Browse All ›

- Cases Case Digests Federal Court Decisions State Court Decisions

- People & Community People & Community Q&A Career Annoucements Obituaries

- Judges & Courts Part Rules Judicial Ethics Opinions Court Calendar Court Notes Decision - Download Court Calendar - Download

- Public Notice & Classifieds Public Notices & Classifieds Place a Public Notice Search Public Notices Browse Classifieds Place a Classified

- All Sections Events In Brief Columns Editorials Business of Law NY Top Verdicts Instant Insights Special Sections The Newspaper Special Supplements Expert Witness Search Lawjobs Book Center CLE Center Video Sitemap

Assignments and Security Interests Under UCC Article 9: A Worthy Decision

The March 2020 Commentary and its accompanying amendments to the Official Comments are critical steps in getting the commercial finance industry and, more importantly, courts aligned on how 9-406 and 9-607 work in concert.

December 16, 2022 at 10:30 AM

11 minute read

Share with Email

Thank you for sharing.

The basic definitions of Article 9 align with this approach of applying to both an assignment of payment rights and a security interest in such assets. “[S]ecurity interest” in UCC Article 1, §1-201(b)(35) (General Definitions), includes “any interest of a … buyer of accounts, chattel paper, a payment intangible or a promissory note in a transaction that is subject to Article 9.” The definition of “secured party” in Article 9, §9-102(a)(73) (Definitions and Index of Definitions), includes a “person in whose favor a security interest is created or provided for under a security agreement,” as well as a “person to which accounts, chattel paper, payment intangibles or promissory notes have been sold.” Finally, the definition of “debtor” in Article 9, §9-102(a)(28), includes both a “person having an interest, other than a security interest or other lien, in the collateral” and a “seller of accounts, chattel paper, payment intangibles or promissory notes.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Go to Lexis

Not a Lexis Subscriber? Subscribe Now

Go to Bloomberg Law

Not a Bloomberg Law Subscriber? Subscribe Now

Why am I seeing this?

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

You Might Like

NY Photographer's Revived Suit on Working Same-Sex Weddings Could Signal Incoming Wave of Litigation

By Brian Lee

Is Courthouse Sacrosanctity a Thing of Yesteryear?

By Joel Cohen and Bonnie M. Baker

In Absence of a 502(d) Order, Court Finds Waiver of Privilege

By Christopher Boehning and Daniel J. Toal

Recent Developments Under New York’s Amended Whistleblower Protection Law

By Nicholas J. Pappas and Elena Modl

Trending Stories

'Do I Want to Make Partner?' Here's Why More Are Answering 'No'

The American Lawyer

Polsinelli Lateral Group from Holland & Knight Totals 47, Includes Philly Leader

Milbank Rolls Out Summer Bonuses for Associates, Counsel

Five Latham & Watkins Partners Exit for Sidley Austin in London

International Edition

In Malpractice Suit Against Anesthesiologist, $4.2M Settlement Is Far Greater Than Insurance Coverage

- 25 Years of the Am Law 200: Is Size as a Strategy a Winning Formula?

- People, Places & Profits, Part III: Are Law Firm Financial Metrics Keeping Pace With Inflationary Growth?

- The A-List, Innovation, and Professional Development: How Market Trends Are Impacting What it Takes to Be a Well-Rounded Firm

Featured Firms

Law Offices of Gary Martin Hays & Associates P.C. 75 Ponce De Leon Ave NE Ste 101 Atlanta , GA 30308 (470) 294-1674 www.garymartinhays.com

Law Offices of Mark E. Salomone 2 Oliver St #608 Boston , MA 02109 (857) 444-6468 www.marksalomone.com

Smith & Hassler 1225 N Loop W #525 Houston , TX 77008 (713) 739-1250 www.smithandhassler.com

Presented by BigVoodoo

More From ALM

- Events & Webcasts

The New York Law Journal honors attorneys and judges who have made a remarkable difference in the legal profession in New York.

The African Legal Awards recognise exceptional achievement within Africa s legal community during a period of rapid change.

Consulting Magazine identifies the best firms to work for in the consulting profession.

Description: Fox Rothschild has an opening in the Atlantic City, NJ office for a litigation associate to join a fast-paced, national litigat...

Our client, a litigation services boutique, is seeking to add a Coverage & Commercial Litigation Attorney to support their rapidly growi...

Cicchiello & Cicchiello, LLP - Hartford Law Firm seeking to hire an Associate Attorney. We focus our practice primarily on Personal Inju...

Professional Announcement

Full Page Announcement

Subscribe to New York Law Journal

Don't miss the crucial news and insights you need to make informed legal decisions. Join New York Law Journal now!

Already have an account? Sign In

Transfer of Membership Interest in LLC: Everything to Know

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. 3 min read updated on October 29, 2020

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

This is a short, somewhat easy document to create. It contains places for both the person transferring the interest (Assignor) and the person receiving the interest (Assignee) to complete the document. It includes details on both parties, as well as the membership interest. You will include the membership percentage, whether it comes with voting rights or not, and there is an addendum that handles the consent of all LLC members if required.

LLC Membership Interest Assignments fall under individual state laws because LLCs are managed by individual state regulations, not federal law. You may hear this form referred to by several other names:

- LLC Interest Assignment Agreement

- Interest Assignment for LLC Membership

- Assignment of Interest for LLC

- Membership Assignment for LLC

- Member Interest Transfer for LLC

Transfer of Interest in Delaware LLCs

Changes are inevitable in business, and LLCs are no different. If you happen to have set up your LLC in Delaware , it's quick and easy to transfer membership interests without expensive amendments. The Delaware LLC Operating Agreement details all conditions of future sales and/or transfers. It's typically handled internally with amendments and there is no need to record the change of interest with the state's Division of Corporations .

Transferring LLC Ownership

There are a number of reasons ownership may change. Some of these include:

- Desire to bring in new members

- A member passes away, gets divorced, or becomes disabled

- Someone wants to leave the LLC

- You want to sell the entire business

The procedure to transfer ownership is dictated by whether you are transferring only a portion of the whole LLC. Are you only bringing on a new member and therefore only need to change name and ownership percentages? Each member owns a percentage of the business, and if you want to add someone new, you will need to transfer some of the existing membership interests. If you have an Operating Agreement, it should provide details on how business transfers are to be handled.

It's important to have buy-sell, or buyout, provisions in your Operating Agreement , which detail how ownership changes work, as agreed upon by all members. Buy-sell provisions detail the method of how to value the business and membership interests, and it might place restrictions on who can become a member or the requirement to buy back interests from a member who is departing. If you don't have an Operating Agreement , or you have one but it doesn't contain buy-sell provisions, you'll need to look at your respective state statutes on how membership transfers are to be handled.

If your current Operating Agreement is lacking, it's a good idea to amend it or complete a new one. You may need to in order to document the ownership changes. If you don't need a new agreement, you at least need an amendment that lists any new members and their interest percentages.

Selling the LLC to a Third Party

Buy-sell provisions in an Operating Agreement don't cover selling the business to a third-party. To sell the business, you need to find a buyer and agree on the selling price. You may need the services of an experienced business valuation expert and/or have the buyer examine your books. There may be complex financial implications connected with the sale. It's recommended you consult with an attorney who is well-versed in buying and selling LLCs.

Abandoning LLC Membership Interests

One method of getting rid of your LLC interest is to just abandon it if that is allowed under state and the specific LLC's Operating Agreement. To establish abandonment, the person giving up the interest must provide notice to the LLC and other members that they are abandoning their membership rights and interests. This does not require the consent of the remaining members. However, it does not eliminate any personal liability the member had to third parties prior to the abandonment.

If you have questions regarding a transfer of membership interest in LLC, you can post your legal need on UpCounsel's marketplace. UpCounsel only accepts the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- LLC Purchase Agreement

- LLC Membership Interest Transfer Agreement

- LLC Membership Interest

- Selling an LLC Business

- How to Change LLC Ownership

- LLC Transfer Of Ownership Form

- Sale of Membership Interest in LLC Form

- Sale of LLC Membership Interest

- LLC Change of Ownership Form

- Can You Sell an LLC

Assignment of Contract

Jump to section, what is an assignment of contract.

An assignment of contract is a legal term that describes the process that occurs when the original party (assignor) transfers their rights and obligations under their contract to a third party (assignee). When an assignment of contract happens, the original party is relieved of their contractual duties, and their role is replaced by the approved incoming party.

How Does Assignment of Contract Work?

An assignment of contract is simpler than you might think.

The process starts with an existing contract party who wishes to transfer their contractual obligations to a new party.

When this occurs, the existing contract party must first confirm that an assignment of contract is permissible under the legally binding agreement . Some contracts prohibit assignments of contract altogether, and some require the other parties of the agreement to agree to the transfer. However, the general rule is that contracts are freely assignable unless there is an explicit provision that says otherwise.

In other cases, some contracts allow an assignment of contract without any formal notification to other contract parties. If this is the case, once the existing contract party decides to reassign his duties, he must create a “Letter of Assignment ” to notify any other contract signers of the change.

The Letter of Assignment must include details about who is to take over the contractual obligations of the exiting party and when the transfer will take place. If the assignment is valid, the assignor is not required to obtain the consent or signature of the other parties to the original contract for the valid assignment to take place.

Check out this article to learn more about how assigning a contract works.

Contract Assignment Examples

Contract assignments are great tools for contract parties to use when they wish to transfer their commitments to a third party. Here are some examples of contract assignments to help you better understand them:

Anna signs a contract with a local trash company that entitles her to have her trash picked up twice a week. A year later, the trash company transferred her contract to a new trash service provider. This contract assignment effectively makes Anna’s contract now with the new service provider.

Hasina enters a contract with a national phone company for cell phone service. The company goes into bankruptcy and needs to close its doors but decides to transfer all current contracts to another provider who agrees to honor the same rates and level of service. The contract assignment is completed, and Hasina now has a contract with the new phone company as a result.

Here is an article where you can find out more about contract assignments.

Assignment of Contract in Real Estate

Assignment of contract is also used in real estate to make money without going the well-known routes of buying and flipping houses. When real estate LLC investors use an assignment of contract, they can make money off properties without ever actually buying them by instead opting to transfer real estate contracts .

This process is called real estate wholesaling.

Real Estate Wholesaling

Real estate wholesaling consists of locating deals on houses that you don’t plan to buy but instead plan to enter a contract to reassign the house to another buyer and pocket the profit.

The process is simple: real estate wholesalers negotiate purchase contracts with sellers. Then, they present these contracts to buyers who pay them an assignment fee for transferring the contract.

This process works because a real estate purchase agreement does not come with the obligation to buy a property. Instead, it sets forth certain purchasing parameters that must be fulfilled by the buyer of the property. In a nutshell, whoever signs the purchase contract has the right to buy the property, but those rights can usually be transferred by means of an assignment of contract.

This means that as long as the buyer who’s involved in the assignment of contract agrees with the purchasing terms, they can legally take over the contract.

But how do real estate wholesalers find these properties?

It is easier than you might think. Here are a few examples of ways that wholesalers find cheap houses to turn a profit on:

- Direct mailers

- Place newspaper ads

- Make posts in online forums

- Social media posts

The key to finding the perfect home for an assignment of contract is to locate sellers that are looking to get rid of their properties quickly. This might be a family who is looking to relocate for a job opportunity or someone who needs to make repairs on a home but can’t afford it. Either way, the quicker the wholesaler can close the deal, the better.

Once a property is located, wholesalers immediately go to work getting the details ironed out about how the sale will work. Transparency is key when it comes to wholesaling. This means that when a wholesaler intends to use an assignment of contract to transfer the rights to another person, they are always upfront about during the preliminary phases of the sale.

In addition to this practice just being good business, it makes sure the process goes as smoothly as possible later down the line. Wholesalers are clear in their intent and make sure buyers know that the contract could be transferred to another buyer before the closing date arrives.

After their offer is accepted and warranties are determined, wholesalers move to complete a title search . Title searches ensure that sellers have the right to enter into a purchase agreement on the property. They do this by searching for any outstanding tax payments, liens , or other roadblocks that could prevent the sale from going through.

Wholesalers also often work with experienced real estate lawyers who ensure that all of the legal paperwork is forthcoming and will stand up in court. Lawyers can also assist in the contract negotiation process if needed but often don’t come in until the final stages.

If the title search comes back clear and the real estate lawyer gives the green light, the wholesaler will immediately move to locate an entity to transfer the rights to buy.

One of the most attractive advantages of real estate wholesaling is that very little money is needed to get started. The process of finding a seller, negotiating a price, and performing a title search is an extremely cheap process that almost anyone can do.

On the other hand, it is not always a positive experience. It can be hard for wholesalers to find sellers who will agree to sell their homes for less than the market value. Even when they do, there is always a chance that the transferred buyer will back out of the sale, which leaves wholesalers obligated to either purchase the property themselves or scramble to find a new person to complete an assignment of contract with.

Learn more about assignment of contract in real estate by checking out this article .

Who Handles Assignment of Contract?

The best person to handle an assignment of contract is an attorney. Since these are detailed legal documents that deal with thousands of dollars, it is never a bad idea to have a professional on your side. If you need help with an assignment of contract or signing a business contract , post a project on ContractsCounsel. There, you can connect with attorneys who know everything there is to know about assignment of contract amendment and can walk you through the whole process.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Lawyers

With over ten years of intellectual property experience, I’m happy to work on your contractual matter. I am very diligent and enjoy meeting tight deadlines. Drafting memoranda, business transactional documents, termination notices, demand letters, licenses and letter agreements are all in my wheelhouse! Working in a variety of fields, from construction to pharmaceutical, I enjoy resolving any disputes that come across my desk.

Matt is a licensed attorney based out of Dallas, Texas. Despite having recently graduated, Matt has been immersed in the world of Corporate law throughout law school and beyond. As a result, he has benefitted from the unique and advantageous position of experiencing and working on a wide array of matters, such as reviewing, drafting and negotiating contracts, overseeing regulatory compliance, business formation, risk management, and much more. Contact Matt today for a free consultation!

I have practiced law for more than 35 years in the State of Texas. I am proud of the relationships I have formed with my clients and the high level of legal advice I have provided over these many years. I am responsive and will promptly address your particular situation. For 35 years I have counseled individuals, partnerships and corporations with regard to business formation, real estate transactions and issues, employer/employee relationships, contracts, estate planning and asset protection. I am licensed to practice law in all state courts in Texas and all federal courts. I have represented plaintiffs and defendants throughout the state in cases ranging from contract disputes to injury claims. I have worked with every type of business you can imagine from individuals to "mom and pop" businesses and businesses with assets of more than $10,000,000. My clients' businesses range from large construction contractors, investment companies, oil and gas companies, and commercial landlords, to name a few.

After graduating law school in 2015, I practiced for a few years in LA, then becoming a contractor for large litigation projects. Now working from home in Kansas, I can offer LA service at Midwest prices.

Ms. Tanu Chaturvedi Esq. brings vast experience: experience as Corporate Counsel at a multi-million dollar international corporation, experience as a legal & business leader in the legal department at the world's leading mission capability integrator in the nation's capital that has been named a Top 100 Employer Forbes by state & Top 25 Defense Contractor in the world & named Top 7 in the Washington Technology Top 100 2022 & one of the largest defense contractors in the marketplace & has also been named as Top Managed Company by The Wallstreet Journal & included in the Inc. 500, experience as the sole Attorney at a national company that was recognized in 2017 as a top employer in the capital by "The Washington Post" & has also been listed on the Inc. 5000 more than once as one of the fastest growing companies in the nation, & in 2019, & named as a Finalist for the DC Moxie award: for businesses that demonstrate significant boldness & innovation in business strategy, experience working at one of the world's largest insurance brokerage firms, one of the largest law firms in the capital, a boutique start-up that specializes in investigations, security, & risk, the world’s largest professional service firm (largest of the “big 4” companies) in conjunction with the nation’s executive law enforcement agency, experience working at a corporation with global reach that was lead by a former cabinet member of the Clinton administration, experience working at a Fortune 500 in one of the world's largest insurance markets, at an internationally recognized boutique law firm, experience as the only female legal professional in the felony division of a criminal department in the nation's most dangerous jurisdiction as an undergrad, & experience working in the offices of public officials. She is also a graduate from two different internationally recognized institutions that have a record of turning out graduates with the skill to lead in their industries & distinguished law school graduate from an ABA accredited law school that received recognition for academic & leadership achievement. She is an invited contributor to legal blogs, and she enjoys advocating for increased literacy. Notably, she also supports advocacy for the performing arts as a former graduate of a magnet school for the performing arts. Please don’t hesitate to reach out to her with any questions, and she looks forward to hearing from your team.

I am an attorney licensed in California with particular experience in local policy work, workplace justice, and environmental law. I have authored or co-authored over 30 amicus briefs (including one for which I received an Amicus Service Award from the International Municipal Lawyers Association), have extensive experience researching state law across the country and across issue areas, and pride myself in clearly and concisely distilling complex and/or technical legal concepts for lawyers and non-lawyers alike.

Courtney A.

Hello! I am a transactional attorney enthusiastic about helping entrepreneurs launch and protect their businesses. Let me know how I can support you with drafting and negotiating contracts, setting up your LLC, copyrighting creative content, or trademarking your brand. I am experienced with drafting and negotiating business contracts, including service/vendor agreements, NDAs, marketing agreements, licensing agreements, terms & conditions, terms of use, and many more! I have helped companies develop strong template agreements and strategies for contract management. My goal is to deliver a simple, stress-free client experience!

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Need help with a Contract Agreement?

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

CONTRACT LAWYERS BY TOP CITIES

- Austin Contracts Lawyers

- Boston Contracts Lawyers

- Chicago Contracts Lawyers

- Dallas Contracts Lawyers

- Denver Contracts Lawyers

- Houston Contracts Lawyers

- Los Angeles Contracts Lawyers

- New York Contracts Lawyers

- Phoenix Contracts Lawyers

- San Diego Contracts Lawyers

- Tampa Contracts Lawyers

ASSIGNMENT OF CONTRACT LAWYERS BY CITY

- Austin Assignment Of Contract Lawyers

- Boston Assignment Of Contract Lawyers

- Chicago Assignment Of Contract Lawyers

- Dallas Assignment Of Contract Lawyers

- Denver Assignment Of Contract Lawyers

- Houston Assignment Of Contract Lawyers

- Los Angeles Assignment Of Contract Lawyers

- New York Assignment Of Contract Lawyers

- Phoenix Assignment Of Contract Lawyers

- San Diego Assignment Of Contract Lawyers

- Tampa Assignment Of Contract Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- More Blog Popular

- Who's Who Legal

- Instruct Counsel

- My newsfeed

- Save & file

- View original

- Follow Please login to follow content.

add to folder:

- My saved (default)

Register now for your free, tailored, daily legal newsfeed service.

Find out more about Lexology or get in touch by visiting our About page.

Avoiding the Pitfalls of Assigning an Interest in an LLC Blog Bradley Business Divorce

One of the goals in a business divorce is finality – ending a business relationship once and for all. But what if the end isn’t really the end?

When members of limited liability companies (LLCs) sell their interests in the LLCs to a third party, they may assume that the sale provides the desired end of their rights and obligations related to the company. But that may not be the case. It is possible that even after selling and assigning an LLC interest, the assignor may continue to owe fiduciary duties to the LLC and its members. This post reviews some of the pitfalls of assigning an LLC interest and discusses strategies that may help to avoid those problems.

The Texas LLC Act – Provisions Governing Assignments of LLC Interests

Chapter 101 of the Texas Business Organizations Code (the “LLC Act”) governs LLCs. The LLC Act provides that a member of an LLC may transfer his or her membership interest to another party in whole or in part. But the assignment of an LLC interest is different from the transfer of membership in the company. The assignment of the LLC interest does not give the assignee the rights to (1) participate in the management and affairs of the company; (2) become a member of the company; or (3) exercise any rights of a member of the company. The assignment of the LLC interest provides the assignee with the right to receive distributions issued by the company and information about the company’s finances, but that’s about it.

The LLC Act spells out these rights of the assignee: “An assignor of a membership interest in a limited liability company continues to be a member of the company until the assignee becomes a member of the company.” Further, the assignor does not have the right under the LLC Act to withdraw as a member from the company. (An LLC member also cannot be expelled from the company.) The result is that even after assignors assign the LLC interest and are enjoying “life on the beach,” they may still owe fiduciary duties as a member of the company.

As a side note, this discussion has assumed that there are fiduciary duties owed within the LLC at issue. But that is not always the case. The LLC Act permits the members to agree in the company’s certificate of formation or operating agreement to modify or even eliminate all fiduciary duties that are owed to the company and its members by the managers of the LLC. Tex. Bus. Org. Code § 7.001(d)(3). While including such a provision would certainly make it safer for a member to assign an LLC interest, doing so poses its own set of risks while the company is operating.

A Case Study: Villareal v. Saenz

The problem of fiduciary duties persisting after an assignment may sound far-fetched, but it is a real concern. In Villareal v. Saenz , the co-owners of an LLC agreed to a business divorce in which Saenz assigned the entirety of his interest in the company to Villareal. 5:20-cv-571, 2021 WL 1986831, at *2 (W.D. Tex. May 18, 2021). The assignment was part of a broad release of claims, both known and unknown. Villareal later filed suit, alleging that before signing the release, Saenz had engaged in various acts of misconduct, including misappropriating company trade secrets and embezzling funds, and that after the release, Saenz had taken over the company’s web and email domain, pulled down the website, and offered to sell it back to Villareal for $7,000.

A magistrate judge in the Western District of Texas recommended that all claims based on alleged acts arising before the release should be dismissed for failure to state a claim. But the magistrate judge also recommended that the claims against Saenz based on actions that allegedly took place after the release – including those for breach of fiduciary duty – should proceed. The court concluded that Saenz had not demonstrated that his fiduciary duties ended when he assigned his interest in the company to Villareal, and he may have breached those fiduciary duties by maintaining dominion and control over the company’s email server and website.

Conclusion and Recommendations